A deal that is closed but not complete, in terms of the transition of thousands of financial advisors, has been the biggest and most important M&A transaction of the year.

LPL Financial expects to onboard Commonwealth Financial Network’s advisors in the fourth quarter of 2026, but the billion-dollar deal has rippled through the industry as the firms’ many rivals eagerly attempt to poach teams ahead of the transition. The mega deal is just one of the half dozen ways that independent wealth management firms further consolidated this year.

The “continued presence of private equity in the wealth management space” is driving many big firms to get even bigger, and one aspect of that revolves around creating new revenue streams by providing “more holistic advice to a sticky client base” with new layers of service, said Jessica Polito, founder of M&A advisory firm Turkey Hill Management. Amid that backdrop, the market for sellers looks “incredibly efficient on the economic side,” she noted, with a smaller spread between the lowest and highest offers for registered investment advisory firms and other independent advisor teams.

“The thing that we’ve been preaching for years and years is cultural fit, but it’s taken on a new level of importance as new buyers have entered the market and economic efficiency has become less of a concern,” Polito said. “Because there are more sellers now, buyers get to be more picky about who their partners are going to be. It’s become a lot more about matchmaking than about getting the best price, because you’re going to get the best price.”

That said, a seller’s ability to grow will influence whether they net the highest possible valuation — as will the plans of founders and other key personnel to either retire or stay on board operating the business, she noted.

These days, the largest wealth management firms and RIA aggregators — some on their second or third rounds of private equity capitalization — could reach past 20 times their earnings before interest, taxes, depreciation and amortization. But only a handful of firms can hope to get close to that level.

“Very few firms are going to get an EBITDA multiple in the mid- to high teens at close,” Polito said. Since private equity and other capital-backed buyers “have a mandate to grow,” those firms are “looking for partners that already have a proven ability to grow that they can supercharge,” she added. “It’s easier to achieve with a firm that has already demonstrated growth on its own.”

In the competition raging across wealth management’s independent channels, advisors need “someone in your corner” in the form of an industry M&A expert, Polito noted. While lawyers can draft and explain deal terms, a seasoned dealmaker can assess the possible market and organize bids.

“When you’re selling your firm it’s probably your first time doing it, and you’re probably selling it to someone who’s done it more than once,” she said.

Scroll down for an overview of the main drivers of consolidation across the independent channels of wealth management. And follow these links to see the lists from last year, 2023, and 2022.

A sector-shaping deal

Any time one wealth management firm pays $2.7 billion to buy another with about 3,000 advisors, it’s going to be an important deal to the industry. But LPL’s acquisition of Commonwealth — a firm that was proudly privately held for decades with a closely guarded culture — has taken on special meaning. And rival firms are pouncing on potential recruits.

READ MORE:Beyond Commonwealth: Inside LPL’s plans to maintain its growth course, LPL recruiters pivot to wirehouses as Commonwealth retention nears goal, Why one Commonwealth advisor went RIA amid scores moving to rivals, Osaic CEO on LPL’s Commonwealth promises and why headcount isn’t everything, Even before LPL stepped in, Summit Wealth was leaving Commonwealth, LPL’s Steinmeier ‘maniacally focused’ on making Commonwealth advisors feel at home, LPL to ‘bend’ to become more like Commonwealth, Steinmeier says

Frenetic deal volume, big moves

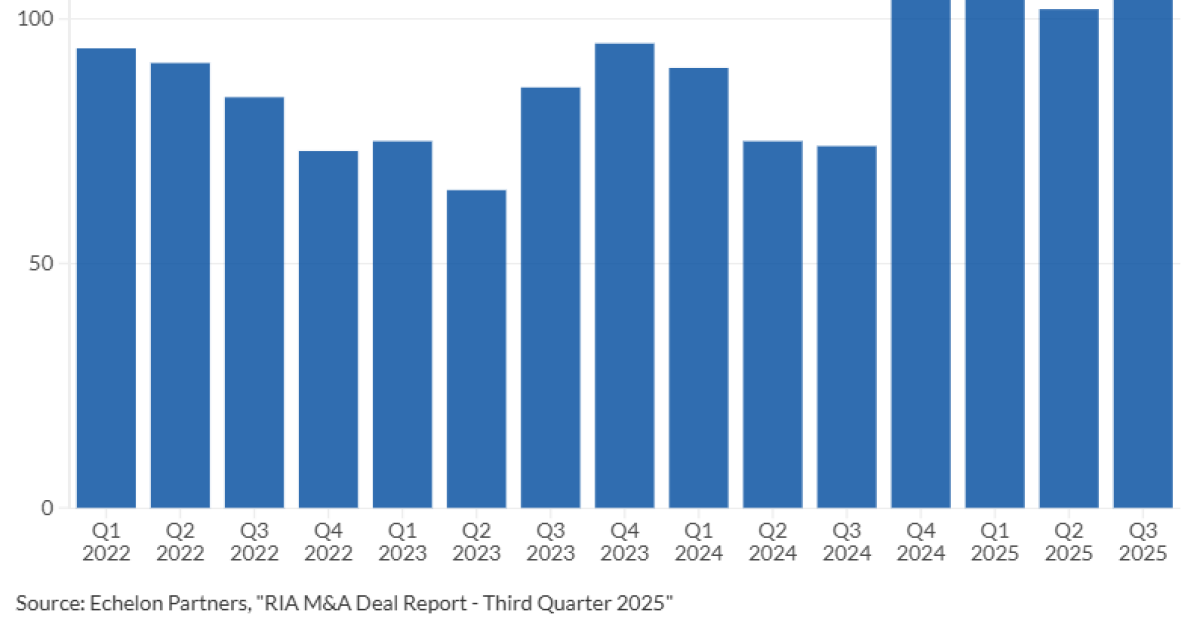

Even though LPL’s acquisition of Commonwealth has received more attention than any other recruiting move or M&A deal this year, the record pace of acquisitions has fueled several hundred other deals in the industry’s independent channels.

READ MORE:Creative Planning nears $640B AUM with SageView deal, Savant adds PrairieView Partners, Exclusive: Steward Partners acquires $481M RIA, What LPL, Atria layoffs say about the firm’s M&A strategies, Osaic buying CW Advisors, a firm with $13.5B fee-only AUM, Simon Quick deal proves private equity not required for growth, Team dropping LPL affiliation highlights uphill battle to keep advisors, Dynasty brings over $6.4B RIA from Raymond James

New business lines, internal consolidation and tech integrations

To gain an edge, independent advisors and wealth management firms frequently launch new ventures involving more types of client services, switch up their internal structure, or pursue new professional designations. These are some examples.

READ MORE:Dynasty collab vets options for indie-curious wirehouse advisors, Certificate on business owner exits offers advisors skills in growth area, ‘Akin to exhaustion’: 3 signs fintech sector could see a shakeout, Flourish deal will give RIAs tools to compete with banks on lending, Carson Group launches tax program led by veteran planner, Focus rebrands ‘hubs,’ sets eyes on M&A in new year, Focus Financial looks north of the border with new internal ‘hub’, LPL takes minority stake in OSJ Private Advisor Group, Schwab to buy private firm marketplace Forge for $660M

Buyer strategies

Investors in wealth management are multiplying, in terms of their ranks and how much they’re willing to pay for the valuable recurring revenues of RIAs and other advisory practices. They’ll have to fend off tough competition to land the industry’s most profitable firms and the talent that fuels them.

READ MORE:How to grow through M&A: What RIAs should know, How financial advisors can buy a wealth book of business, How financial advisor compensation is crucial to succession and M&A, Firms that can and can’t fetch 20-times EBITDA with private equity

Seller strategies

Advisors who have built successful businesses are fielding frequent outreach messages from potential investors interested in bidding on their firms. But they won’t have to give up control of their company until they’re ready and they’ve found the right fit.

READ MORE:Amid frenetic deal pace, 2 strategies for RIA sellers to consider, PE plays for midsize RIAs could shift M&A dealmaking, Why advisors should look closely at Raymond James’ equity offers, With Dynasty backing, new RIA pitches M&A with ‘true ownership’, Think your firm’s worth 16x EBITDA? Not so fast, say valuation experts, For RIAs, minority M&A deals bring liquidity, autonomy — to a point

Consolidation inflection points

With about 25,000 to 30,000 RIAs across those registered with state agencies and the Securities and Exchange Commission, there is no one-size-fits-all answer for companies’ questions about their next step. And, despite the capital flowing into the industry, that means no single independent firm could ever be everything to everyone.

READ MORE:The RIA race to $1B — and whether it’s worth running, How advisors can scale their firms with talent, organization, empathy, High-stakes hires: How a growing RIA can recruit financial advisors, Why and when do financial advisors change firms? It’s complicated