Building a Successful RIA: Choosing the Right Successor

This article is the 28th installment in a Financial Planning series by Chief Correspondent Tobias Salinger, focusing on how to build a successful Registered Investment Advisory (RIA) firm. To read the previous stories, click here, or follow Salinger on LinkedIn here.

Registered investment advisory firm founders who have built profitable businesses with a stable client base eventually face the decision of choosing a successor. With a significant portion of financial advisors in the industry expected to retire in the next decade and a potential shortage of professionals compared to the demand for advice, RIA successors will either emerge internally or through an acquisition. Each path presents its own set of challenges and benefits, ultimately shaping the future of the firm.

Internal Successions vs. Acquisition

Internal successions often come with a “natural discount of at least 30%” compared to selling to private equity-backed firms or other RIA consolidators. Steven Tenney, founder of consulting firm Grandview & Co., emphasizes the importance of empowering the next generation of successors to ensure a smooth transition. Developing successors and creating a solid succession plan are crucial steps for any RIA looking to maintain its legacy and client relationships.

On the other hand, external acquisitions may offer a more lucrative exit strategy but come with potential challenges such as transitioning clients to a new advisor and less autonomy in the process. Succession planning should be viewed as an integral part of business operations rather than a one-time event, aligning with good business practices.

By the Numbers

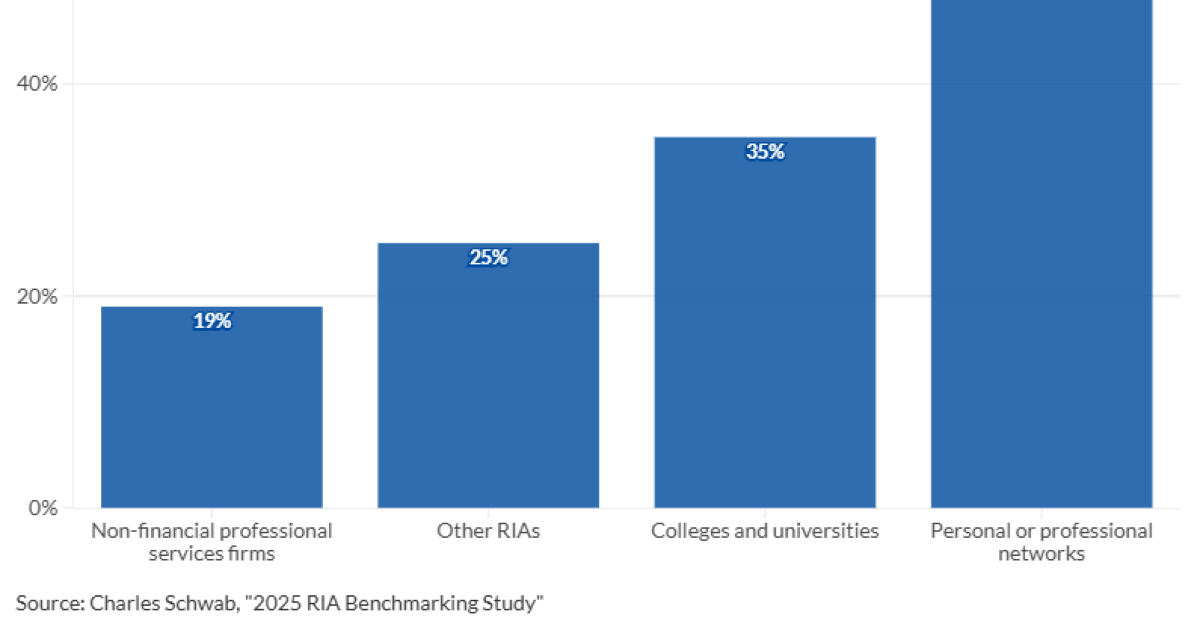

Recent data shows that RIAs are increasingly recognizing the importance of hiring new talent. According to Charles Schwab’s RIA Benchmarking Study, a majority of RIAs hired employees last year, with firms planning to add more roles in the next five years. However, a significant percentage of RIAs, especially those with fewer than $250 million in client assets, lack a succession plan, highlighting the need for proactive planning in the industry.

Most RIA founders prefer internal succession plans over external deals, citing benefits such as legacy preservation, long-term client relationships, and leadership opportunities for current staff members. While internal transitions may involve lower multiples compared to external deals, they offer a more personalized approach to succession and continuity for clients.

Takes Two or More to Tango

Choosing successors for an RIA involves careful consideration of skills, willingness, and timelines. Brandon Kawal of Advisor Growth Strategies recommends having multiple successors for each founder selling equity, ensuring alignment in leadership roles and responsibilities. Succession planning requires a focused approach to compensation, career paths for successors, and specialized roles within the firm to facilitate a smooth transition.

David Grau, CEO of Succession Resource Group, emphasizes the importance of hiring the right people to build a successful RIA team. Successors should be nurtured and trained intentionally, similar to building a sports team with a mix of experienced professionals and young talent.

Beginning the Handoff

Executing an internal succession plan requires meticulous documentation, training, and gradual handover of responsibilities. Founders must be willing to delegate tasks and empower successors to take on leadership roles within the firm. Dominique “Dom” Henderson’s experience with succession planning highlights the importance of grooming successors, involving them in client relationships, and preparing them for ownership.

Internal succession can be challenging due to factors such as financing, succession training, and the emotional attachment of founders to their businesses. However, with careful planning and a focus on mentorship, RIAs can ensure a successful transition to the next generation of leaders.

Conclusion

Choosing the right successor for an RIA is a critical decision that impacts the firm’s future success and client relationships. By understanding the benefits and challenges of internal successions versus acquisitions, founders can make informed choices that align with their long-term goals. Succession planning should be viewed as an ongoing process that requires collaboration, mentorship, and a clear vision for the firm’s legacy.

For more information on hiring and advancing an RIA successor, visit here.