Independent Registered Investment Advisors (RIAs) face numerous challenges in their industry, but advisors who have firsthand experience highlight one particular obstacle: finding a balance between offering personalized service and meeting the demands of growth.

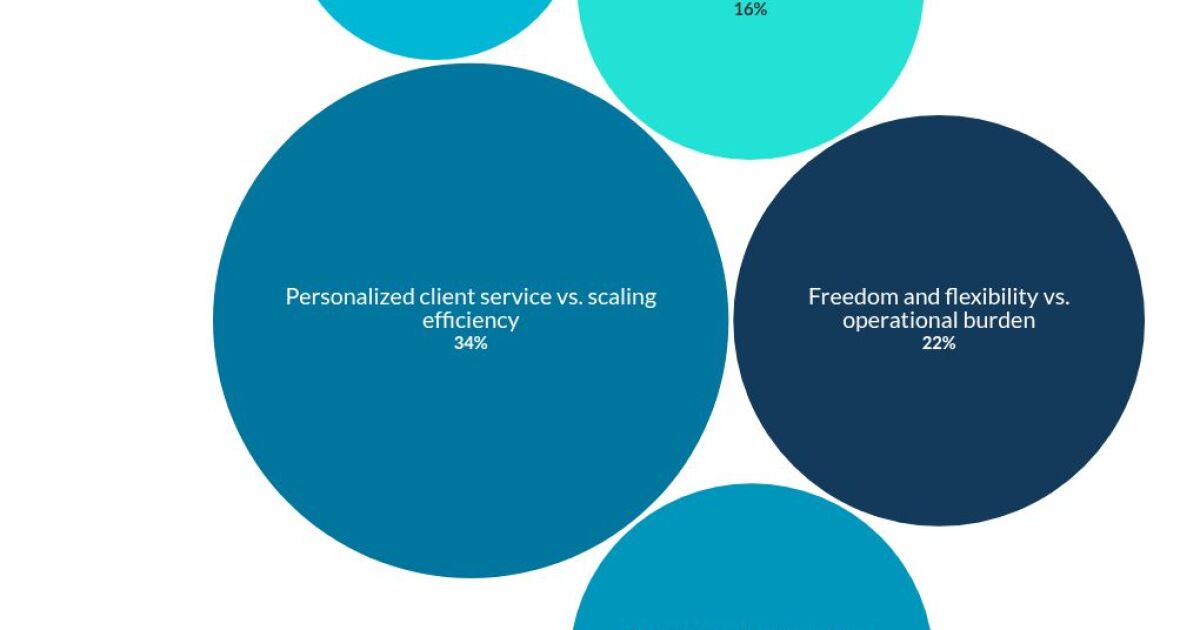

According to Financial Planning’s latest Financial Advisor Confidence Outlook (FACO) survey, one-third of advisors identified “personalized client service vs. scaling efficiency” as the most significant trade-off they encounter.

Advisors emphasize that maintaining a focus on both aspects requires making tough decisions regarding how to expand while ensuring clients feel valued and heard.

Making clients feel heard while scaling the business

Personalization in financial advising undoubtedly requires time and effort. Hardik Patel, the founder of Trusted Path Wealth Management in Santa Rosa, California, notes that independent RIAs often navigate this balancing act by utilizing model portfolios, outsourcing investment management, or standardizing the financial planning process.

However, Patel highlights that these approaches may limit the depth of tailored advice provided to each client. Instead, he opts to construct and manage each client’s portfolio based on their individual goals, preferences, tax considerations, and unique circumstances. Behind the scenes, streamlined workflows and organized processes help him maintain efficiency.

“Each client receives planning components that are truly relevant to them,” Patel explains. “This approach enables me to maintain some efficiency while ensuring each client feels understood and supported.”

While this focus may restrict the number of clients he can effectively serve, Patel views this as a deliberate choice.

“I only take on new clients when there is a clear mutual fit, allowing me to uphold the level of care, attentiveness, and passion that defines my work,” he adds.

Patel believes that clients engage his services because of his dedication to understanding their goals, values, and unique circumstances. By working closely with a select number of clients, he can nurture strong, trusting relationships that often lead to referrals.

Peyton Falkenburg, executive vice president of NBC Securities in Birmingham, Alabama, acknowledges that tailored communication is a primary challenge for most advisory teams at his firm. Investors consistently view customized guidance as a key factor in establishing trust.

Freedom and flexibility versus operational burden

According to the November FACO survey, the second most challenging aspect for independent RIAs is the balance between “Freedom and flexibility versus operational burden,” with over 20% of respondents expressing concerns in this area.

Brandon Galici, a financial planner and founder of Galici Financial in San Juan Capistrano, California, emphasizes the importance of having robust systems and processes in place to ensure consistent high-quality service for every client.

Galici underscores the need for flexibility to quickly adapt processes based on client requirements. He prioritizes outcomes over blindly following procedures to ensure clients feel genuinely understood and valued.

Falkenburg points out that the independence enjoyed by advisors often brings added operational burdens, diverting time and attention away from clients. Technological independence can introduce integration complexities that impact productivity.

Addressing fee transparency, pricing pressures, and operational investments becomes crucial as advisors strive to demonstrate the value they provide. Falkenburg emphasizes the importance of removing operational friction to remain responsive and focused on each client’s unique needs and concerns.

When operational processes run smoothly, advisors can dedicate more time to building relationships and delivering personalized service, ultimately enhancing the client experience.

For more information, you can visit the source link here.