Latham & Watkins and Kirkland & Ellis: Leading Legal Advisers in Global Mergers and Acquisitions

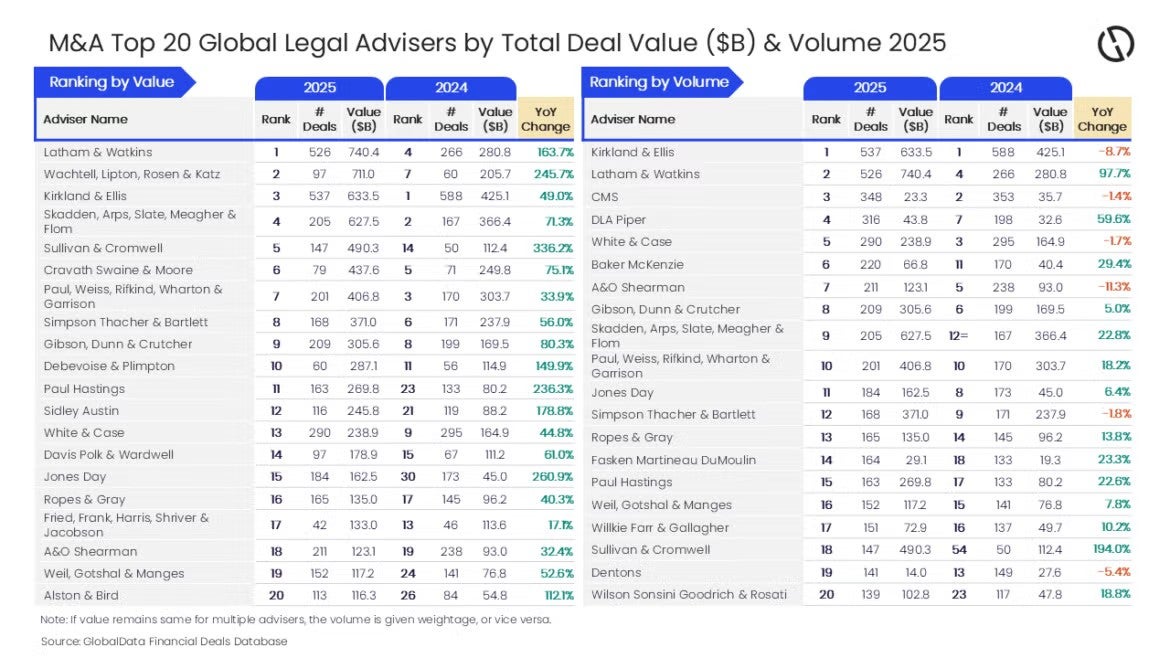

According to the latest data from GlobalData’s Legal Advisers League Table, Latham & Watkins and Kirkland & Ellis emerged as the top legal advisers for global mergers and acquisitions in 2025.[1]

Strong Performance by Value and Volume

Per GlobalData’s Financial Deals Database, Latham & Watkins led in terms of deal value, providing advisory on deals worth an impressive $740.4bn.[1] On the other hand, Kirkland & Ellis, having provided legal counsel on a staggering 537 deals throughout the year, topped the volume chart.[1]

A Competitive Landscape

Other noteworthy firms in the field included Wachtell, Lipton, Rosen & Katz, which took the second spot by value with advisory on deals amounting to $711bn.[1] Kirkland & Ellis ranked third in terms of value, advising on deals worth $633.5bn.[1] Completing the top five by value were Skadden, Arps, Slate, Meagher & Flom and Sullivan & Cromwell, advising on deals worth $627.5bn and $490.3bn respectively.[1]

In terms of deal volume, Latham & Watkins followed closely behind Kirkland & Ellis with involvement in 526 deals.[1] This was followed by CMS, DLA Piper, and White & Case, involved in 348, 316, and 290 transactions respectively.[1]

Expert Analysis and Insights

According to Aurojyoti Bose, a lead analyst at GlobalData, Kirkland & Ellis managed to maintain its leadership position in 2025 after topping the volume chart in 2024. However, it faced close competition from Latham & Watkins.[1] Both law firms were the only advisers involved in over 500 deals during the year.[1]

Notably, of the 526 deals advised by Latham & Watkins in 2025, 108 were billion-dollar deals, including 17 mega deals valued at or more than $10bn.[1] This involvement in big-ticket deals helped the firm top the table by value that year.[1]

Methodology of Rankings

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites, and other reliable sources available in the secondary domain.[1] A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.[1] For added robustness, the company also seeks submissions of deals from leading advisers.[1]

For a deeper insight into the industry, you can access the original source Here.