Activist Investor HoldCo Drops Proxy Threat Against KeyCorp and Eastern Bankshares

In a surprising turn of events, HoldCo Asset Management, the activist investor, has withdrawn its threat of proxy contests against KeyCorp and Eastern Bankshares. This development is a stark contrast to last year when HoldCo criticized both banks for allegedly overpaying for acquisitions and diluting shareholder value.

HoldCo’s Change of Stance

HoldCo Asset Management’s decision to back down from proxy contests comes in light of the significant changes made by both banks to protect shareholder rights and increase market value. The South Florida-based investment firm commended the leadership of KeyCorp and Eastern Bankshares for their efforts to make these changes.

HoldCo, which remains a shareholder in both banks, continues to monitor the banks’ activities closely. The firm announced that it will not hesitate to take necessary action, including launching proxy battles or advocating for sales, should either bank carry out actions inconsistent with HoldCo’s expectations or to the detriment of shareholders.

Implications for KeyCorp and Eastern Bankshares

While HoldCo’s change of stance brings relief to both banks, it does not entirely eliminate the threat. The investment firm continues to watch the banks closely and may take action if necessary. However, it has lauded the efforts made so far, particularly praising Eastern Bankshares’ changes to enhance shareholder value. Nevertheless, HoldCo maintains its viewpoint that Eastern should ultimately be sold, with M&T Bank as the ideal buyer.

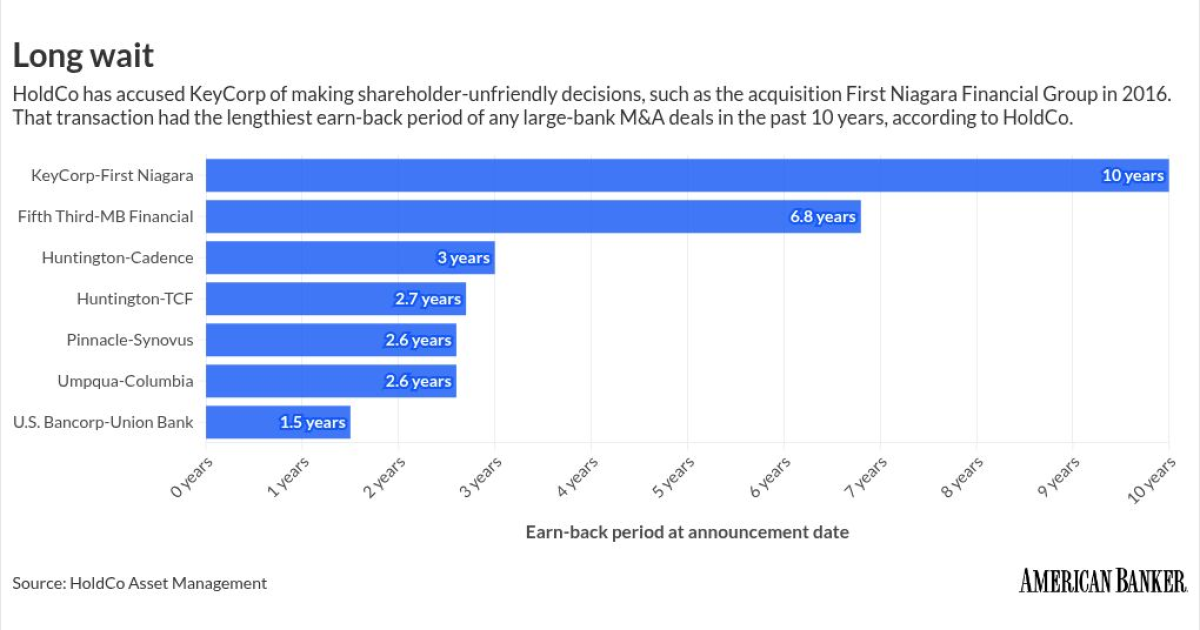

KeyCorp was previously criticized by HoldCo for overpaying for its 2016 acquisition of First Niagara Financial Group. HoldCo also called for CEO Chris Gorman’s dismissal. However, the firm now supports Gorman, citing his willingness to change as an indication of his suitability for leadership. KeyCorp has addressed some of HoldCo’s criticisms, such as reiterating its focus on organic growth, outlining a share buyback acceleration plan, and making changes to its board.

HoldCo’s Activism in the Banking Sector

The withdrawal of proxy threats against KeyCorp and Eastern Bankshares marks the end of a busy six-month period for HoldCo. During this time, the firm launched public activist campaigns against five banks, including Dallas-based Comerica, which was subsequently sold to Fifth Third Bancorp.

HoldCo also disclosed its behind-the-scenes dialogue with four other relatively small banks that have since made significant changes to their strategies. This list includes Central Pacific Financial in Honolulu; TrustCo Bank Corp. NY in Glenville, New York; Capitol Federal Financial in Topeka, Kansas; and Heritage Commerce in San Jose, California.

As a result of these efforts, the management teams and boards of the banks involved made substantive changes that significantly altered the trajectory of their institutions.

Conclusion

HoldCo’s decision to back down from its proxy threats against KeyCorp and Eastern Bankshares is a testament to the significant changes made by these banks to protect shareholder rights and boost market value. While this brings relief to both banks, it also serves as a reminder of the activist investor’s continued vigilance and its commitment to holding these institutions accountable. As the story unfolds, the banking sector will be closely watching how these changes impact KeyCorp and Eastern Bankshares, as well as HoldCo’s next moves.

For additional details, please see the original article Here.