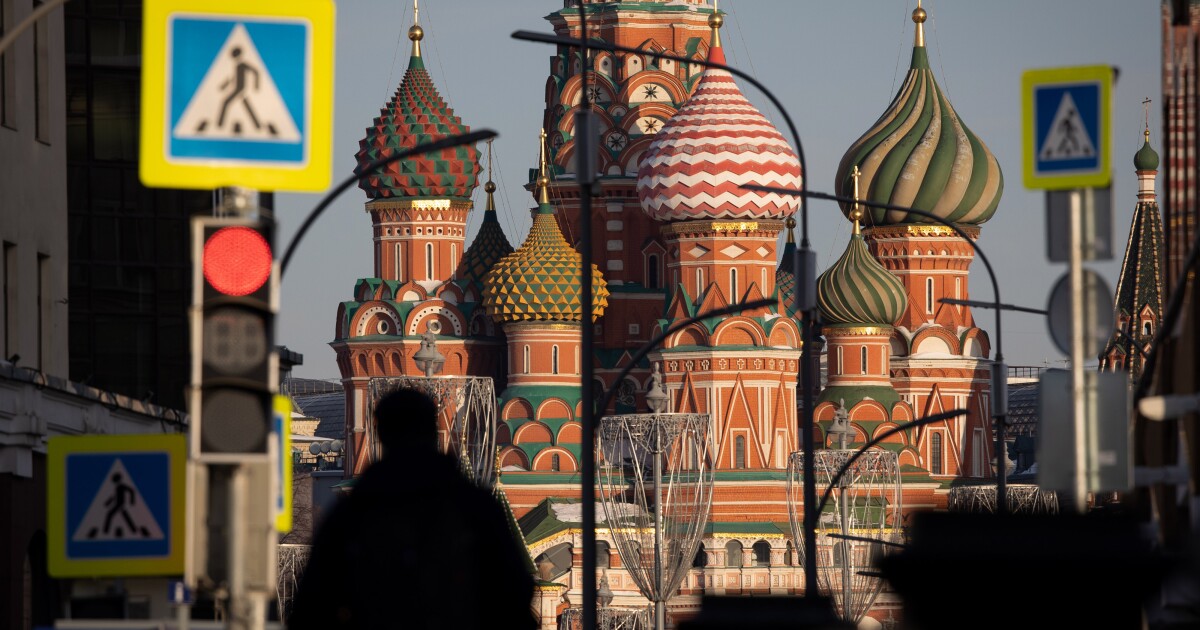

Citi Group Completes Exit from Russia

Following a process that took nearly four years, Citi Group has finally closed its exit from Russia by selling off its last remaining subsidiary in the country. This decision was made public on Wednesday and marks the end of Citi’s operations in the Russian market.Citi began this process back in March 2022 with a strategic decision to withdraw from its Russian consumer business as part of a broader plan to reduce its global footprint. This move was initiated by the company’s CEO at the time, Jane Fraser.

Details of the Transaction

The sale of AO Citibank, as the subsidiary was known, resulted in a significant hit to the company’s financials. In the fourth quarter of 2025, Citi recorded a $1.2 billion pretax loss associated with this transaction. This sale saw the transfer of all of Citi’s remaining businesses in Russia, including approximately 800 employees. However, the specific financial terms of the deal have not been made public.

Reasons for Citi’s Exit

The decision to exit Russia was expanded beyond the consumer business shortly after the country’s invasion of Ukraine early in 2022. The sale of AO Citibank was reportedly approved by Russian President Vladimir Putin to Renaissance Capital in November 2025.

The Future of the Former Citi Unit

Following the transaction, the former Citi unit will now operate under the name AO RenCap Bank, as announced by Renaissance Capital in a press release. The bank will continue to serve its existing clients, including investment banks and funds from the U.S., the United Kingdom, the European Union and other regions. According to Renaissance, AO Citibank has the largest custody operations in Russia, and its acquisition aligns well with the existing business structure of the group.

Impact on Citi’s Financial Position

Despite the large loss incurred from the sale, Citi anticipates a positive impact on its financial position. The bank expects the transaction to provide an estimated benefit of approximately $4 billion to its common equity Tier 1 capital in the first quarter of 2026. Analysts from Piper Sandler have suggested that the overall impact of the transaction should be neutral to Citi’s common equity Tier 1 capital.

The bank has also clarified that the $1.2 billion pretax loss recorded in the fourth quarter was made up of $1.6 billion in currency transaction losses, offset in part by $400 million of expected benefits.

In conclusion, Citi’s withdrawal from the Russian market is a significant development in the banking industry, signaling the end of an era for the bank’s operations in the country. The impact of this decision, both for Citi and the broader banking sector, will undoubtedly be closely watched by industry observers worldwide.Here