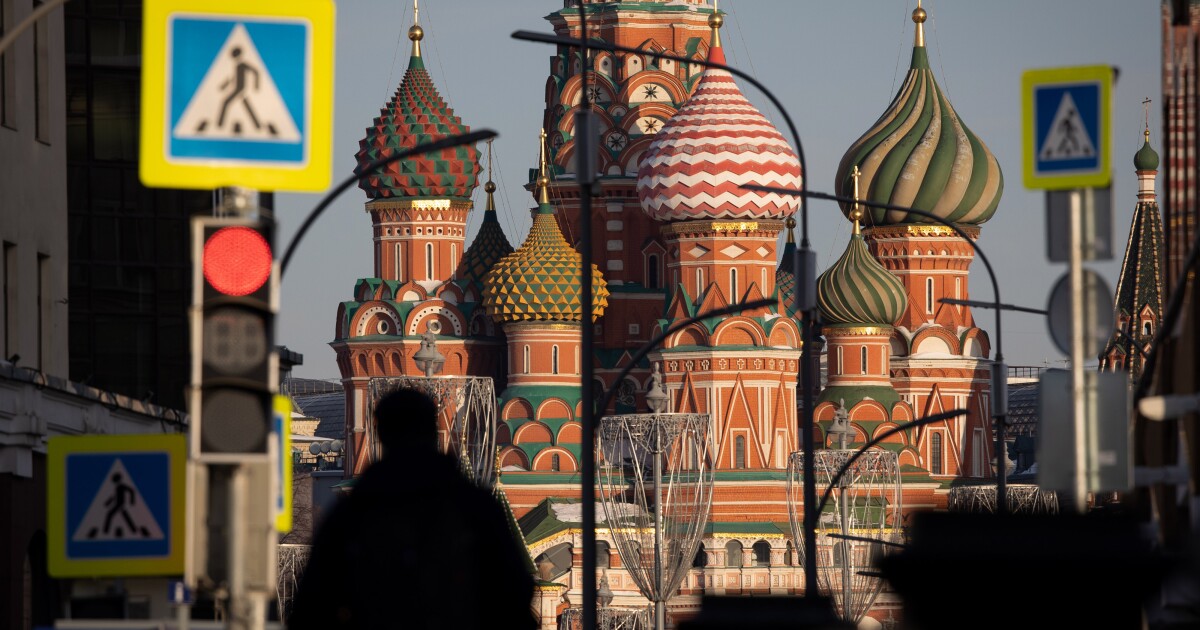

Citi Finalizes Departure from Russian Market

In a significant move, Citi has successfully concluded the sale of its former subsidiary in Russia, AO Citibank, to Renaissance Capital. This development signifies the bank’s total exit from the Russian market. This strategic decision impacts approximately 800 employees working in the country.

An Approved Transaction

The agreement covering all remaining business activities in Russia received the necessary approvals from both the political and the corporate world. Russian President Vladimir Putin sanctioned the deal in November of the previous year, and the internal approval within Citi followed in December.

A Strategic Exit

The banking giant first expressed its intention to withdraw from the Russian consumer market in April 2021. By March 2022, it expanded its exit strategy to include other business segments. The sale has now successfully navigated all necessary regulatory barriers.

Financial Impact of the Divestment

Citi estimates this divestment will contribute approximately $4bn to its common equity tier 1 (CET1) capital during the first quarter of 2026. This projection is based on several factors, including reduced risk-weighted assets, lower deferred tax assets, and the release of losses related to currency translation. Even though the $1.6bn currency translation adjustment loss is realized, Citi considers it neutral for its regulatory capital over time.

Legal Aspects of the Transaction

The transaction was legally advised by Skadden, Arps, Slate, Meagher & Flom.

Words from Citi’s International Head

Ernesto Torres Cantú, the head of Citi International, appreciated the professionalism and hard work of his colleagues throughout this process. He stated, “We’ve now completed the final steps in Citi’s exit from Russia, a process that began in March 2022.”

Other Foreign Banks Follow Suit

Meanwhile, other foreign banks are also reevaluating their operations in Russia. In December, Italy’s UniCredit began scaling back its involvement in Russia. This move reportedly involved several executives departing and a significant portion of leasing assets being divested, as reported by Russian business daily Kommersant.

The banking landscape in Russia is changing rapidly with foreign banks revising their strategies. The full implications of these moves are yet to be seen.

For more details, visit the source Here.