Mergers and Acquisitions Boost Bank Deposit Growth in 2025

Recent financial market trends indicate that regional banks that closed M&A deals in 2025 would have experienced a slower-than-average core deposit growth without these acquisitions. This key insight, backed by data from the Invictus Group, reveals that banks in the $10 billion-$100 billion asset tier would have likely grown their core deposits by less than 2%, barring their acquisitions. This revelation is significant given the current boom in the bank M&A scene, with the desire to increase deposit franchises serving as a major motivating factor for buyers. Source.

The Role of M&A in Core Deposit Growth

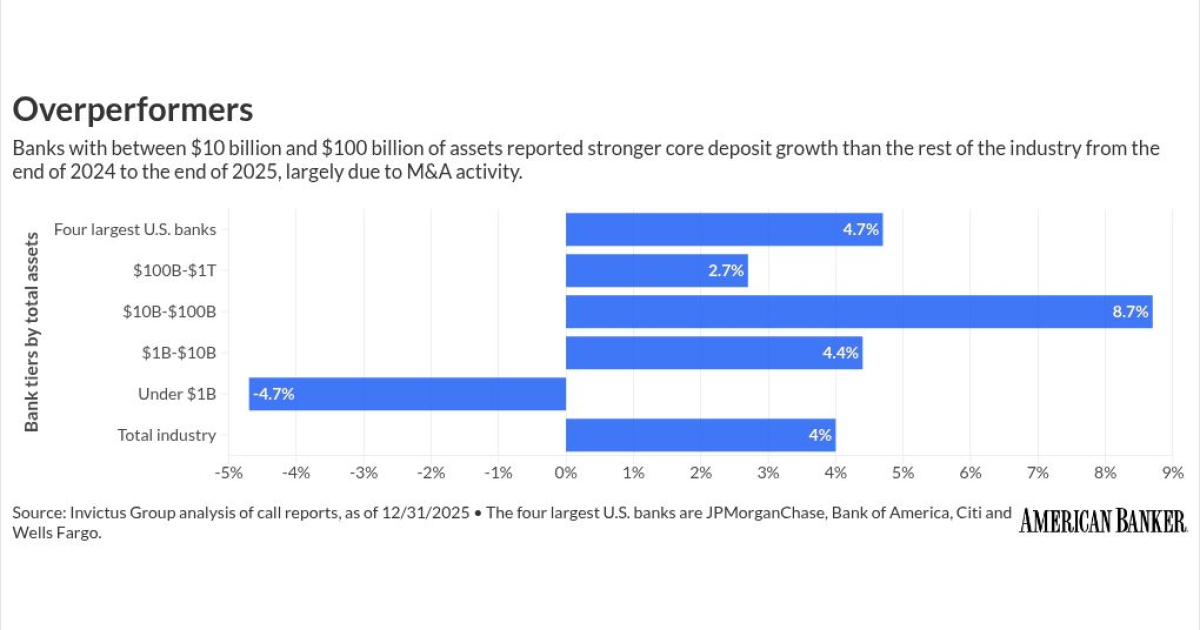

Banks with assets between $10 billion and $100 billion outperformed the broader industry in core deposit growth, a trend largely attributed to M&A activities. According to Invictus Group, the banking industry saw a 4% increase in core deposits in 2025, a figure that marks an improvement from the previous three years marred by rapidly increasing deposit costs and liquidity concerns following a number of bank failures.

The Impact of Mergers and Acquisitions

Adam Mustafa, Invictus Group President, noted that the superior performance of these mid-size regional banks was not solely due to organic growth. In fact, for the 27 banks in this asset tier that bought other banks in 2025, core deposits rose by a collective 29%, over seven times the growth rate of the industry as a whole. Without the impact of these acquisitions, these banks would have experienced a mere 2% increase in their core deposits.

Key M&A Deals in 2025

In 2025, the bank M&A scene started to heat up with over 170 acquisitions, a third more than in 2024. Key examples include the $67 billion-asset Columbia Banking System, which saw its core deposits decline during the first half of the year but rebound by 34% following its acquisition of Pacific Premier Bancorp. Another example is the $31 billion-asset Eastern Bancshares. Although it saw a 20% deposit growth after acquiring HarborOne Bancorp, nearly all of this growth resulted from the acquisition. Without the merger, Eastern’s deposits would have slightly decreased from the previous year.

Challenges in Deposit Growth

Despite the positive impact of M&A on deposit growth, the banking industry has faced challenges in this area over the past few years. Following the surge in deposits during the COVID-19 pandemic due to stimulus funds, core deposits declined in 2022 and 2023. Even with the Federal Reserve’s interest rate cuts in 2024, the anticipated dramatic drop in deposit-related expenses did not materialize, and deposit cost declines did not keep pace with the 175-basis-point drop in the federal funds rate.

The Future of Deposit Competition

Looking ahead, the competition for deposits is expected to intensify. According to the latest IntraFi Bank Executive Business Outlook Survey conducted in January, nearly 40% of banks have seen an increase in deposit competition over the past year. Almost half of the survey respondents anticipate this competition to further increase in 2026. This highlights the importance of maintaining a balanced growth strategy, where both loans and deposits increase simultaneously.

Conclusion

The future of banking seems to be headed towards more mergers and acquisitions as institutions seek to bolster their deposit growth. While organic growth remains a viable strategy, the advantages of M&A, such as balanced growth and access to new geographies, make it an attractive option for many banks. As the industry continues to evolve, banks will need to make strategic decisions to stay competitive and maintain a healthy balance sheet.