As the software sector experiences a significant downturn, investors and financial experts are casting a wary eye on how this could potentially impact banks’ balance sheets. The uncertainty seems to be doing little to dampen the appeal of bank stocks, which continue to perform well despite volatility in other sectors. This resilience is reminiscent of the aftermath of the dot-com bubble burst in 2000, when banks also outperformed despite some credit losses tied to the tech sector.

The Software Sell-Off and Its Potential Impact on Banks

Recent developments in artificial intelligence (AI) have stirred unease among investors, leading to a sell-off in software stocks. The fear is that the advancements in AI could render some roles in tech companies obsolete, leading to a decrease in the number of software developers. If these companies fail as a result, their loans could potentially go into default, causing a ripple effect on banks that have exposure to these loans.

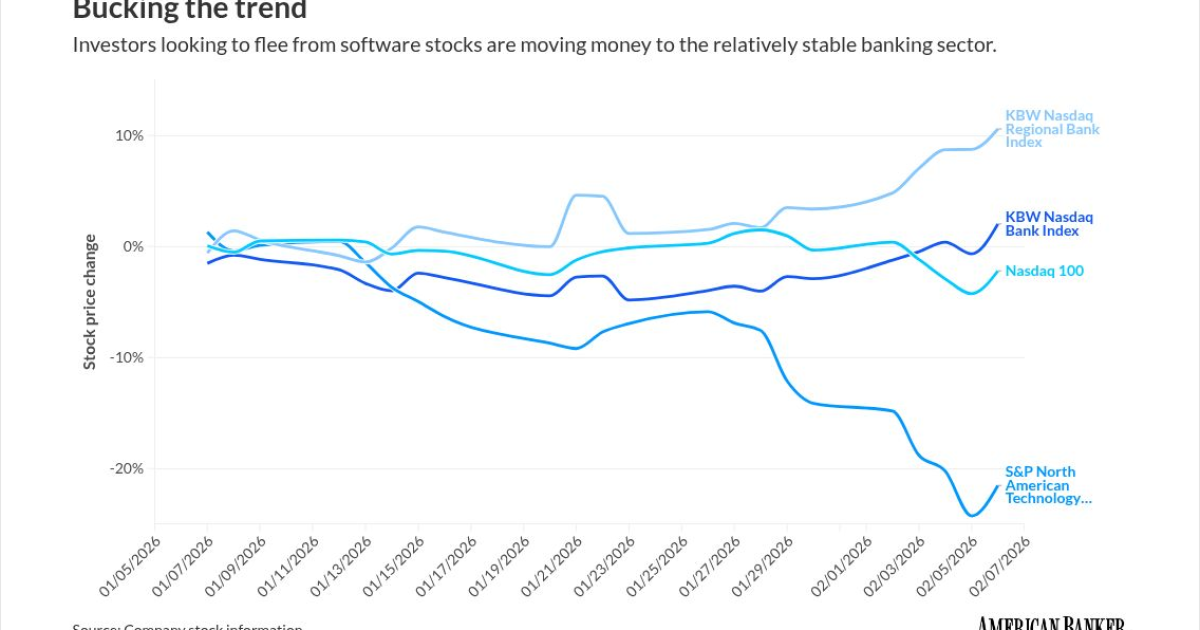

However, banks seem to be weathering this storm rather well. Despite the turbulence in tech stocks, traditional financial institutions have seen steady gains over the past month. The S&P Software Index has dipped by more than 20%, while large and regional bank stocks have risen. This has led to the perception that banks could serve as a safe haven from the downturn in the software sector.

What is at Stake for Banks?

Quantifying the potential impact on banks is complex, largely because many do not categorize their loan portfolios by sector. For those that do, exposure to the software industry is typically grouped under “tech,” “information services,” or the “technology, media and telecom” category. Furthermore, some businesses that fall under different categories, like consumer services, could also be affected by a contraction in the software sector.

Bank of America, one of the few banks that specifies its “software and services” concentration, had approximately $14.6 billion of utilized loans to the industry as of September 30, 2025. This represents about 1.8% of its total utilized commercial credit exposure. Analyst Brian Foran of Truist Securities estimates that across the banking industry, tech makes up less than 3% of total loan books. Still, even a 3% exposure could have significant implications if the software sector crisis deepens.

Historical Precedents and Current Market Dynamics

The banking sector has shown remarkable resilience in the face of tech sector downturns in the past. Following the dot-com bubble burst in the early 2000s, banks managed to weather the storm, despite some credit losses. Foran suggests that the current strength of the banking sector could be due to an influx of new investors seeking safe havens amidst the volatility of other asset classes.

Today, despite uncertainty about their exposure to the software sector, banks are attracting investors looking for stability. The KBW Nasdaq Bank Index has increased by more than 2% over the past month, while the S&P North American Technology Software Index has dipped nearly 22%. The KBW Nasdaq Regional Bank Index, which includes less tech-exposed lenders, is up almost 11%.

It’s clear that in times of market turbulence, the predictable and stable nature of banking stocks holds appeal for many investors. As the software sector continues to fluctuate, banks are standing firm, serving as a testament to their resilience and relative dependability. However, only time will tell how this dynamic will evolve and whether banks can continue to insulate themselves from potential disruptions in the tech sector.

Source: Here