Adobe Stock

Asset Servicing: The Unsung Hero of Financial Services

While asset servicing might not be the glamorous subject of numerous Hollywood movies or best-selling novels, it is an integral cog in the financial services industry. This previously overlooked field is now undergoing significant changes, spearheading the future of financial services. Structural shifts brought about by client and product advancements, coupled with rapidly evolving technology, have demanded a dynamic approach, especially in asset servicing (source).

Embracing the Impact of Artificial Intelligence

Artificial intelligence (AI) has undoubtedly been the most significant technological revolution of our generation. Implementations such as machine learning and large language models are becoming ubiquitous, proving their capacity to deliver faster, more intelligent solutions. AI is currently driving efficiency, capacity, throughput, and risk reduction in both large and small ways(source).

The Hybrid Workforce of the Future

As AI becomes more prevalent, the workforce of the future is shaping up to be a hybrid one. This mix includes high-value human work and oversight coupled with digital employees who are responsible for learning, executing, and improving baseline processing. The Bank of New York Mellon Corporation (BNY) already employs over 100 of these digital employees, who undertake tasks ranging from generating autonomous code to validating payment instructions – a clear sign of AI’s transition from experimental to industrial usage.

The Tipping Point of Digital Assets and Blockchain

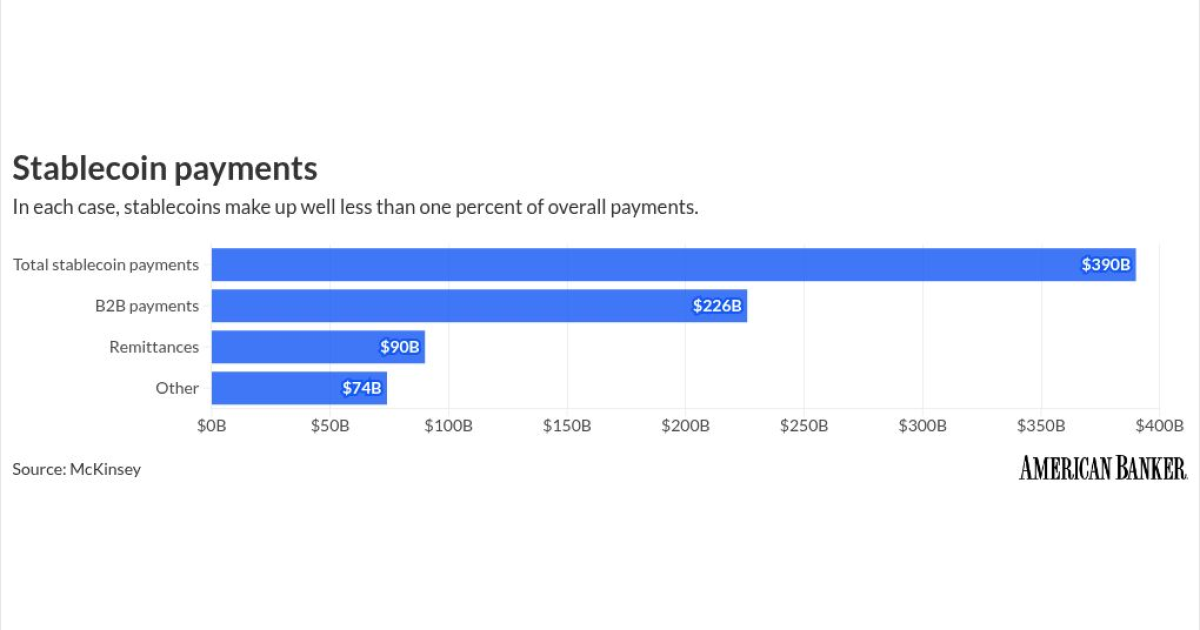

Although discussions surrounding digital assets and blockchain have been ongoing for years, we are now reaching a tipping point. The increasing institutional adoption of blockchain technology, and the advent of tokenization and digital cash equivalents (such as stablecoins), are collectively reshaping our perspective on the investment lifecycle (source).

Integration of Market Infrastructure

Investor behaviors are shifting, and as a result, the future of financial markets lies in the seamless integration of market infrastructure to support both traditional assets and on-chain instruments. It’s imperative to retool the traditional pathways of custody, investor solutions, fund services, clearing, and so forth, to meet our clients’ evolving needs and deliver with efficiency, transparency, and resilience across both traditional and digital ecosystems. This convergence is essential to drive the next phase of evolution in global financial markets.

The Shift in Investment Trends

Alongside changes in how we invest, what we are investing in is also evolving. The rapid growth in alternatives, particularly in private markets, is driving further complexity and innovation in products. As both institutional and high net worth investors allocate more to private assets, this shift requires new valuation processes and data requirements. The lack of standardization and transparency in private markets has led to more manual processes and bespoke technology, creating challenges yet opportunities for asset servicers that can offer truly integrated outsourced solutions.

Expanding Retail Channels

The decline of traditional pension plans in favor of defined contribution options, the generational transfer of wealth, and the increasing trend of break-away RIAs, among other factors, are all driving the importance of retail channels. Individual investors now demand the same access to and personalization of investment options once only afforded to large institutional players. The ability to support these products and provide access to retail distribution channels has never been more critical.

Future of Asset Servicing

It’s time for asset servicers to transcend our traditional roles and rules to radically reimagine what we do and define the future of finance. This is a call to embrace our essential role at the heart of the financial system and take the lead in shaping the future of our industry.

Source: Here