The Role of Mail Automation in Banking and Finance

In the banking and finance industry, time and precision are crucial elements that determine success. Every document, whether it’s a loan packet, account statement, or compliance notice, carries not just information, but trust. However, many financial organizations still rely on manual processes for mailing these critical documents, leading to inefficiencies that can no longer be tolerated as we approach 2026.

Digital Silk’s research shows that companies using automation achieve a $5.44 return for every $1 invested, primarily because they can respond faster than their competitors. In today’s fast-paced world, speed matters more than ever, and automation has become a non-negotiable requirement for businesses to thrive.

The Impact of Manual Processes in Banking

Research indicates that manual processes cost companies 20% to 30% of their revenue annually. These inefficiencies lead to slower response rates, delayed transactions, and customer frustration. Even small errors can result in compliance complications or client dissatisfaction, adding tangible costs to the organization. In an era where customers expect same-day service and real-time updates, speed and reliability have become crucial competitive differentiators in the banking and finance industry.

Addressing Pain Points with Mail Automation

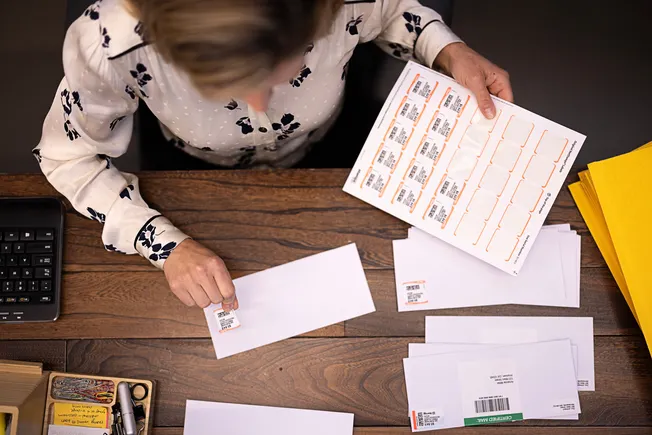

Multi-carrier mailing and shipping software, such as Stamps.com, offer customizations and integrations specifically designed for financial institutions. By streamlining secure customer mail outs and providing exclusive discounts across popular carriers like USPS and UPS, Stamps.com helps banking teams modernize critical workflows and automate repetitive tasks.

Benefits of Mail Automation

1. Accuracy and Compliance: Automation prevents errors that could lead to compliance issues, ensuring precision in every mailing. Tracking tools create an auditable record of shipments and deliveries, simplifying regulatory reporting.

2. Mailing Cost Oversight: By automatically logging and categorizing every stamp and label printed, mailing expenses become more manageable, leading to cost savings and budget control.

3. Compounded Time Savings: Printing postage onsite and scheduling USPS pickups eliminate interruptions and save valuable time that can be redirected towards client service and other high-value tasks.

4. Scalable Systems for Growth: Automation allows for seamless scalability as financial institutions expand or adapt to hybrid work models. Efficient mailing workflows can be replicated across branches or remote teams, ensuring consistent processes and centralized reporting.

The Broader Business Case for Automation

Mailing and shipping automation often triggers a broader transformation within organizations. Companies that implement automation experience lower costs and faster response times compared to those still handling tasks manually. Automation is no longer a luxury but a necessity for competing smarter in today’s market.

By automating mail workflows, financial institutions reclaim valuable time, improve accuracy, and gain insights that inform smarter business decisions. Automation isn’t about doing less; it’s about enabling more time for strategic work. For banking and financial organizations looking to meet the speed and precision requirements of today’s market, mail automation delivers efficiency and more.

Ready to save time through business automation? Discover how Stamps.com’s automated mail processing can transform your team’s productivity.