Community Banks and Credit Unions Embrace Fintech to Boost Onboarding

With the rapid digitalization of banking services, community banks and credit unions are increasingly turning to fintech platforms like Swaystack to enhance their onboarding and direct deposit technology. As these small banks vie for primary status in the customer’s wallet, they face stiff competition from digital-first banks and fintechs. As such, improving the customer experience in the first few months of engagement has become critical.

“The first 60 to 90 days of a relationship are increasingly viewed as the make-or-break window, and better onboarding tools are one of the most measurable ways to improve that outcome,” says Jim Perry, a senior strategist at Market Insights.

The Pain Point of Onboarding

Bank tech entrepreneur Har Raj Khalsa noted a common issue faced by community financial institutions in their conversations. “Banks and credit unions told us that they were really struggling after accounts were opened with getting them activated, fully utilized and onboarded,” Khalsa told American Banker. “They said, ‘We want to win their deposits. We want to win their paychecks to come in the future, and we want to win their recurring payments and transactions.'”

Enter Swaystack

Identifying this as an opportunity, Khalsa, who had previously founded the loan origination and digital account opening startup MK Decision, created Swaystack. This onboarding software startup, launched in April 2024, specifically catered to the needs of the smallest banks and credit unions. Since its inception, the company has onboarded 10 credit unions and eight community banks.

The Importance of Onboarding

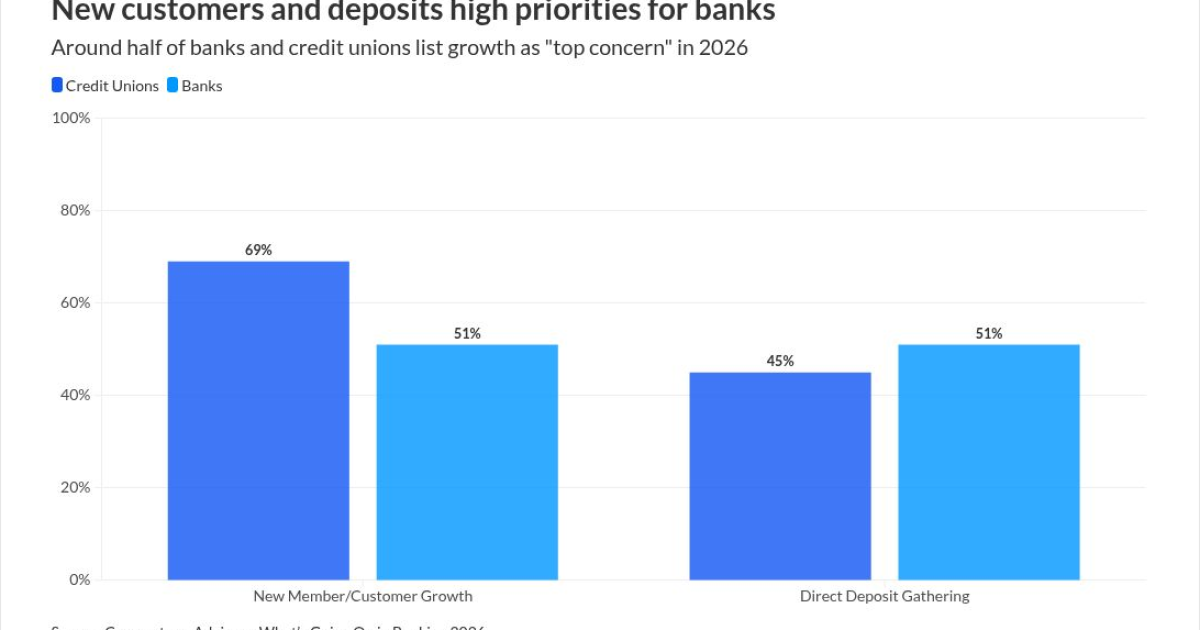

A Cornerstone Advisors banking survey revealed that attracting new customers and gathering deposits are top concerns for banks and credit unions going into 2026. Onboarding plays a crucial role in this, referring to the series of steps that establish the relationship between customer and bank, such as enrolling in digital banking or setting up an ACH direct deposit. Without a robust onboarding strategy, new deposits simply don’t stick around.

Swaystack’s Unique Offering

Swaystack offers a customizable software that institutions can attach to existing online banking platforms. This onboarding ‘switch kit’ helps a newly joined customer bring over additional deposits, their paychecks, and their recurring card transactions. Unlike other digital onboarding fintechs such as nCino, Glide, and MANTL, Swaystack focuses on later-stage onboarding and does not provide account opening software.

Case Study: Kohler Credit Union

Kohler Credit Union, a Wisconsin-based Swaystack client, benefited significantly from the fintech’s onboarding tools. Matt Fehrmann, Kohler’s Chief Information Officer, shared that the onboarding tools prompted a 50% increase in electronic bank statement enrollment among existing digital banking members. The credit union also tracked a 24% increase in newly opened accounts that immediately set up direct deposit.

Competing with Fintech Giants

While Swaystack has been successful in garnering clients, it faces competition from direct deposit-switching fintechs such as Atomic and Pinwheel. To stay competitive, Swaystack is in talks with Pinwheel to connect with its systems in the future due to client requests. The fintech also connects to APIs provided by data aggregators such as Plaid and the income and employment verifier Truv.

The Future of Onboarding

Jim Perry notes that modern consumers are accustomed to seamless, app-first experiences in other areas of daily life. When a community bank or credit union still requires manual PDF forms or trips to HR to set up a direct deposit, that friction can be “increasingly out of step”.

Many smaller institutions are realizing that overhauling their onboarding and direct deposit technology was something they’d put off for too long. The growing attention to onboarding suggests that the battleground has shifted from ‘Can we open accounts online?’ to ‘Can we make becoming, and staying, a customer effortless?’

Read more about this topic here.