Financial Assistance During Government Shutdowns: A Fintech Approach

As the United States grapples with the longest government shutdown in history, spanning 41 days and counting, financial institutions are stepping up to offer aid to consumers in need. With federal litigation casting a shadow of uncertainty over the distribution of November SNAP benefits, banks are turning to fintech-curated community resources for assistance. One such fintech that is making waves in this area is SpringFour.

SpringFour: Connecting Banks to Community Resources

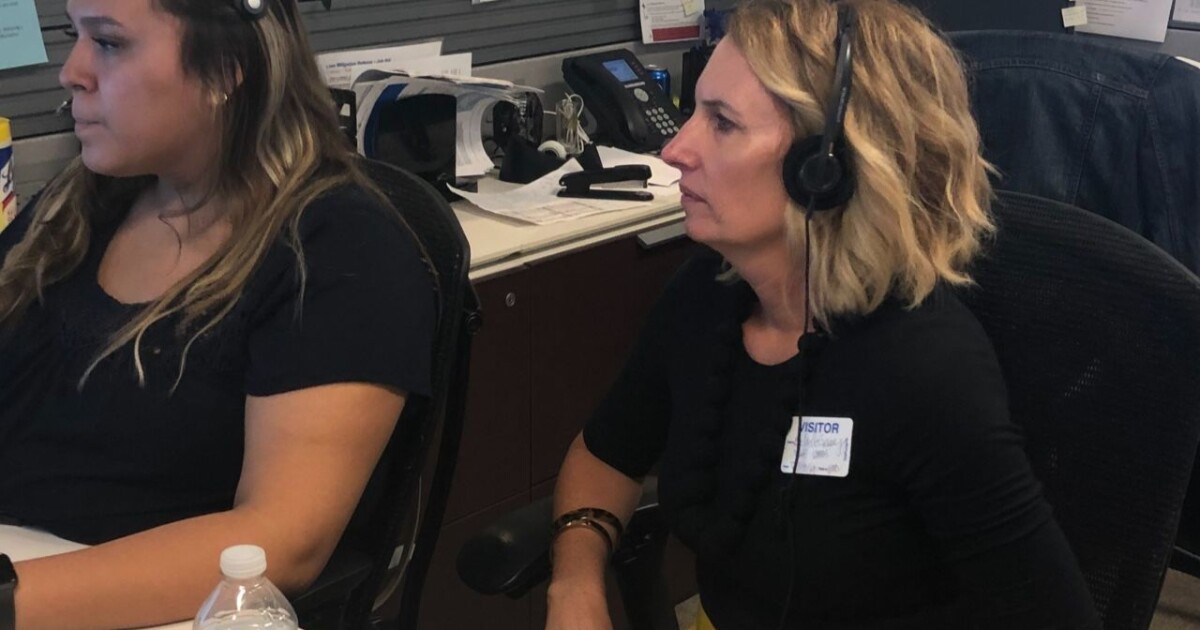

SpringFour, a financial health fintech, is providing a lifeline to consumers by connecting them to vetted nonprofits and community resources. According to SpringFour CEO Rochelle Gorey, banks are keen to utilize SpringFour’s expertise as it’s not in their wheelhouse to curate and vet resources that can assist a person’s financial health.

SpringFour’s business model thrives on contracts with financial institutions. Renowned clients include BMO, Capital One, and Fifth Third. The fintech prides itself in making referrals to nonprofit and government resources that its team independently vets and curates. It does not receive any affiliate or marketing dollars for including organizations within its database, a fact that Gorey believes is crucial to the banks that trust SpringFour to connect their customers to these local resources.

SpringFour’s Impact Over the Years

SpringFour has been around since 2005 and has played a crucial role in supporting consumers through various macroeconomic hardships. These include the 2008 financial crisis, the 2018-2019 government shutdown, and the COVID-19 pandemic. The company believes in encouraging people to access resources in their community that are discounted or free, offering a better solution than loans that people may struggle to pay back.

How SpringFour’s Platform Works

Gorey explains that their technology allows financial institutions to connect consumers to a vast database of resources around the country in 25 different spending categories. Users simply need to enter their ZIP code to search for community resources, which include food savings, utility bills, employment resources, and housing assistance. The platform can be incorporated directly within a bank’s platform or as a co-branded platform via a redirect.

An example of a financial institution utilizing SpringFour’s services is the California-based Golden 1 Credit Union. The credit union has incorporated a redirect to a co-branded platform built by SpringFour on its Financial Wellness webpage.

The Benefits of Partnering with SpringFour

For banks and credit unions that contract with SpringFour, Gorey highlights several benefits, including increased customer retention and engagement, an uptick in brand loyalty and trust, and an increase in repayment rates. The fintech also helps financial institutions deliver on ESG, social impact, and CRA goals.

One successful case study is OppFi, a lending fintech serving underbanked consumers. The company partnered with SpringFour in 2017 and saw encouraging results when they sent out a proactive email campaign to their customers during the recent government shutdown. The campaign saw a 44% open rate, with close to 10,000 customers engaging with the platform and over 5,000 performing a search for local resources.

In conclusion, fintech companies like SpringFour are playing a critical role in helping banks provide financial assistance to their customers during challenging times. By connecting consumers with vetted community resources, they not only help alleviate immediate financial hardships but also contribute to building stronger, more trusting relationships between banks and their customers.

Source: Here