Blockchain technology, the driving force behind cryptocurrencies like Bitcoin, has far-reaching implications that extend well beyond digital currencies. Its ability to offer secure, transparent, and decentralized transactions has captured the attention of the banking sector, which is now exploring ways to leverage blockchain to enhance operational efficiency, reduce costs, and increase security. As blockchain continues to gain traction, it is also reshaping the landscape of banking careers. In this article, we explore the profound impact blockchain technology is having on banking jobs, from the roles it’s transforming to the new career opportunities it’s creating.

What is Blockchain Technology?

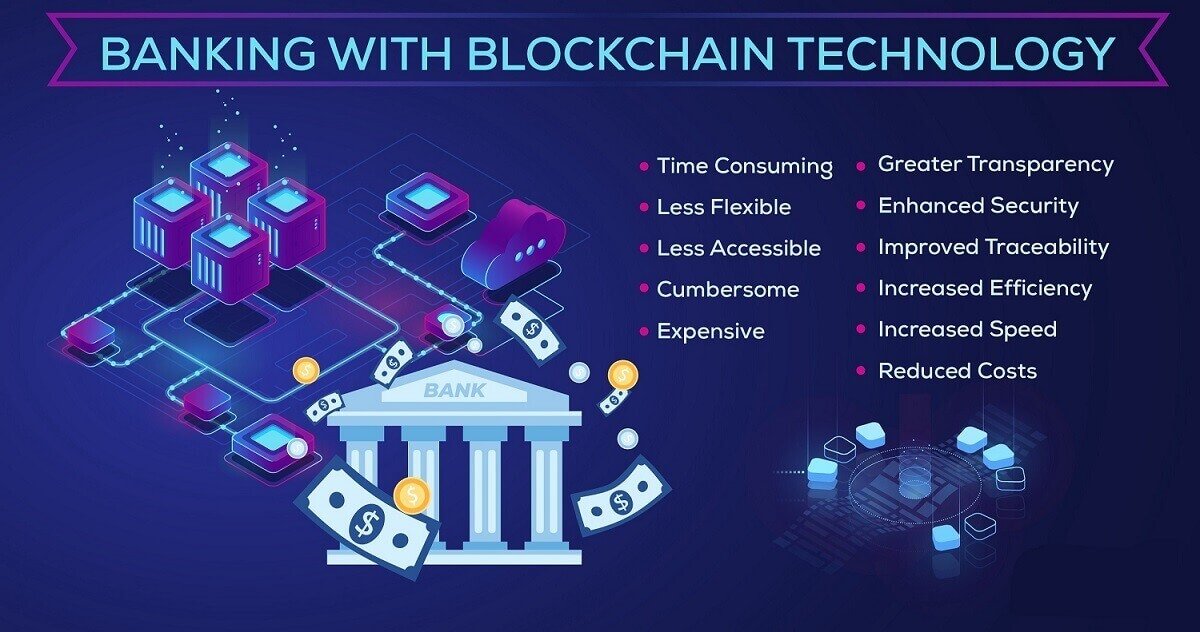

At its core, blockchain is a distributed ledger technology that allows for secure and transparent recording of transactions across a network of computers. Unlike traditional banking systems that rely on central authorities to verify and validate transactions, blockchain operates on a decentralized network, making it resistant to fraud, errors, and interference. Each transaction is recorded in a “block,” which is then linked to previous transactions in a “chain,” ensuring a tamper-proof record.

Banks are increasingly adopting blockchain for various applications, including cross-border payments, fraud detection, smart contracts, and trade settlements. With the potential to revolutionize core banking operations, blockchain is also influencing the careers of professionals in the banking industry.

Transforming Traditional Banking Jobs

As blockchain technology begins to disrupt the banking sector, it is transforming traditional banking jobs in several ways. While some roles may diminish, others will evolve or emerge to meet the demands of blockchain-driven operations.

Automation of Back-End Processes

Blockchain’s decentralized nature allows banks to automate several back-end processes that previously required manual oversight. Activities such as trade settlements, record-keeping, and payment processing can be streamlined, reducing the need for intermediaries. This automation is likely to impact jobs focused on administrative and clerical tasks. However, employees in these roles will need to adapt by learning how to manage blockchain systems and work alongside AI tools that complement these technologies.Enhanced Security and Compliance Roles

With its promise of secure transactions, blockchain is transforming the role of cybersecurity professionals in banking. Blockchain technology makes it easier to track and verify transactions, enhancing fraud prevention and compliance. As a result, the demand for cybersecurity experts who can ensure the security of blockchain implementations will grow. Additionally, compliance officers will need to adapt to the complexities of blockchain-based regulatory frameworks, ensuring that banks comply with laws governing blockchain transactions.Changes to Financial Analysts and Risk Managers

Blockchain has the potential to reshape how financial analysts and risk managers evaluate and monitor transactions. As blockchain provides a transparent and immutable record of financial activity, professionals in these roles will gain access to more reliable data, enabling them to make better-informed decisions. Financial analysts will need to gain expertise in analyzing blockchain-based data, while risk managers will focus on assessing the potential risks associated with blockchain adoption and ensuring that banks remain compliant with evolving regulations.

Emerging Career Opportunities in Blockchain-Driven Banking

Blockchain is also giving rise to entirely new roles within the banking sector. As banks embrace blockchain for its innovative potential, they require specialists who understand the nuances of this technology.

Blockchain Developers and Engineers

Blockchain developers are in high demand as banks seek professionals who can build, implement, and maintain blockchain systems. These professionals are responsible for creating secure, scalable blockchain applications that meet the needs of financial institutions. Blockchain engineers must have strong knowledge of cryptography, programming languages, and distributed ledger technologies to create robust solutions.Blockchain Product Managers

In the blockchain-driven banking sector, product managers are responsible for overseeing the development of blockchain-based solutions. These professionals must understand both the business needs of the bank and the technical requirements of blockchain technology. Blockchain product managers play a key role in driving innovation within banks, identifying opportunities to integrate blockchain into existing services, and ensuring that new products align with the bank’s overall strategic goals.Blockchain Consultants and Advisors

As blockchain technology is still evolving, many banks are seeking external experts to advise on its implementation. Blockchain consultants help banks navigate the complexities of blockchain technology, from identifying use cases to advising on compliance and regulatory issues. With the right expertise, consultants can provide valuable insights into the potential benefits and risks of adopting blockchain solutions.Smart Contract Developers

Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, are one of the most promising applications of blockchain in banking. Smart contract developers work on creating and managing these contracts, ensuring they are secure, efficient, and legally binding. With the rise of decentralized finance (DeFi), smart contract developers are increasingly sought after by banks looking to streamline processes and reduce the need for intermediaries.

Skillsets for Blockchain-Focused Banking Careers

The rise of blockchain technology in banking requires professionals to develop new skills to stay competitive in the job market. Key skills for individuals looking to work in blockchain-powered banking include:

- Blockchain Development and Programming: Knowledge of programming languages such as Solidity, Python, and JavaScript is essential for blockchain developers.

- Cryptography and Data Security: An understanding of cryptographic techniques and how to secure blockchain networks is crucial for cybersecurity professionals.

- Regulatory Knowledge: Given the regulatory complexities surrounding blockchain, professionals will need to stay informed about laws and regulations pertaining to blockchain and cryptocurrency.

- Data Analysis: Blockchain generates vast amounts of data, so professionals must be proficient in data analysis to extract actionable insights.

Conclusion: Embrace the Blockchain Revolution in Banking Careers

Blockchain technology is undeniably transforming the banking industry. While some traditional banking roles may fade, new career opportunities are emerging, offering exciting prospects for those willing to adapt and embrace change. As blockchain continues to evolve, professionals in the banking sector must invest in acquiring new skills to stay ahead of the curve and ensure their relevance in an increasingly technology-driven industry.

For those looking to explore opportunities in the blockchain-driven banking sector, it’s crucial to stay informed, upskill, and be ready to seize the roles that will define the future of finance. Whether you’re an aspiring blockchain developer, a compliance officer, or a financial analyst, understanding the impact of blockchain on banking jobs will give you a competitive edge in your career.