The world of banking is undergoing a significant transformation, driven by technological advancements that are reshaping traditional financial systems. Among the most impactful changes is the rise of digital payments. With the increasing adoption of mobile wallets, e-commerce platforms, and contactless payment solutions, digital payments are revolutionizing how money is exchanged. This shift is not only changing consumer behavior but also creating new career paths in the banking sector, offering exciting opportunities for those interested in finance and technology.

The Rise of Digital Payments

Digital payments encompass a wide range of electronic payment methods, including online banking, mobile payment apps, peer-to-peer (P2P) transfers, digital wallets, and cryptocurrency transactions. Over the past decade, the use of digital payment methods has exploded, with more consumers and businesses opting for the convenience and speed of electronic transactions over traditional cash or card payments.

The COVID-19 pandemic accelerated this trend, as people sought safer, contactless payment methods during lockdowns and social distancing measures. As a result, both traditional banks and fintech companies have been forced to adapt quickly, developing innovative digital payment solutions to meet consumer demands.

The Impact on the Banking Sector

The rise of digital payments has disrupted the traditional banking industry. As more transactions are conducted online, the role of physical branches has diminished, and financial institutions are focusing more on digital channels. This shift has opened the door for new career opportunities in areas such as digital banking, cybersecurity, payment processing, and data analytics.

Digital payments require banks to innovate constantly, enhance their services, and ensure secure transactions. As a result, the demand for skilled professionals who can navigate this evolving landscape has skyrocketed. The following are some of the key areas where digital payments are creating new career paths in banking.

1. Digital Payment Specialists

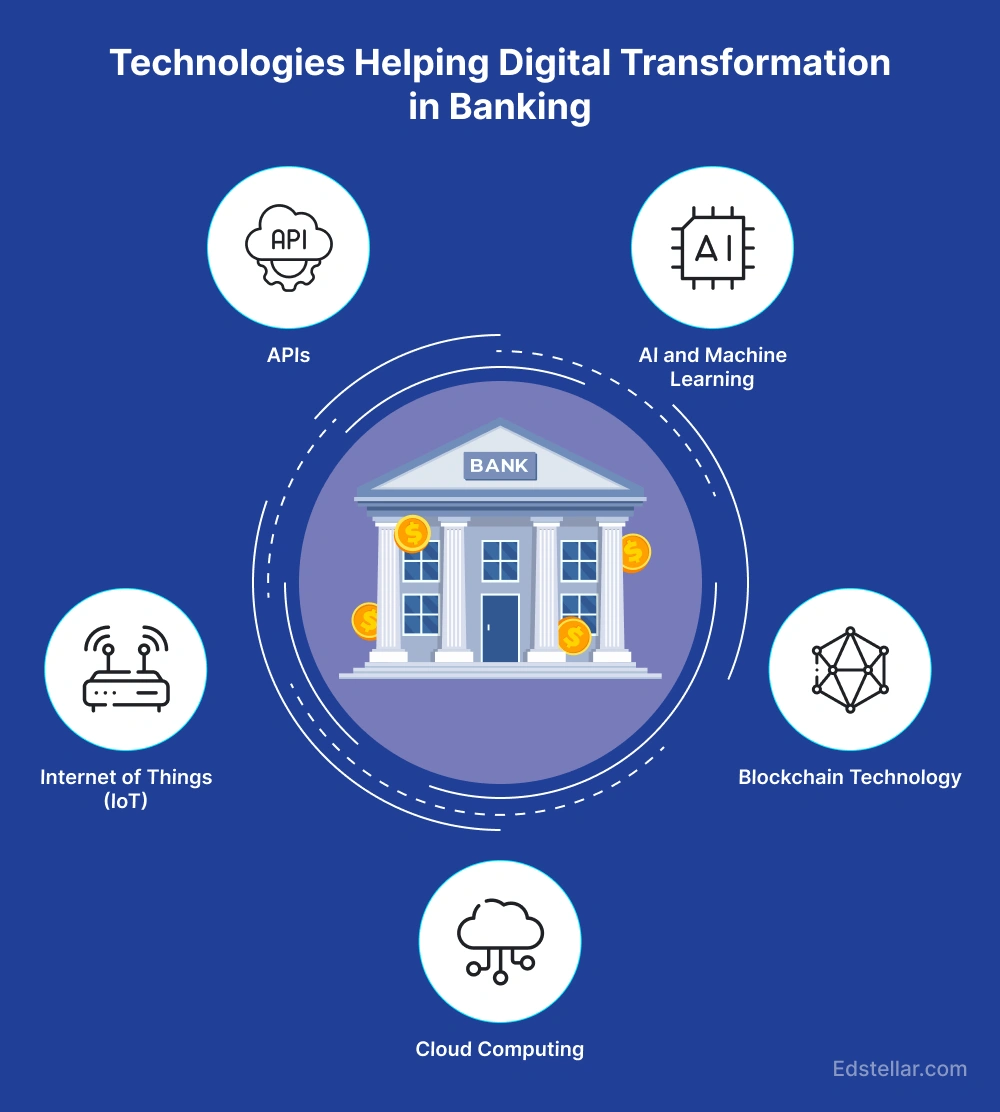

With the growth of digital payments, banks need experts who can design, implement, and manage various payment systems. Digital payment specialists focus on developing and improving online payment platforms, mobile banking apps, and other digital transaction tools. These professionals must have a strong understanding of the latest technologies and trends in payment systems, including blockchain, artificial intelligence (AI), and machine learning.

For individuals interested in both technology and finance, this is an exciting and rapidly expanding career path. Digital payment specialists are essential in ensuring that payment systems are seamless, efficient, and secure, offering valuable career opportunities in the banking sector.

2. Cybersecurity Experts

As digital payments become more prevalent, so does the need for robust cybersecurity. Financial transactions conducted online are vulnerable to cyber-attacks, fraud, and data breaches. Banks are investing heavily in cybersecurity to protect customer data and ensure the integrity of digital payment systems.

Cybersecurity experts in banking are responsible for safeguarding payment platforms, identifying potential threats, and developing strategies to prevent fraud. This field requires professionals with expertise in encryption, risk management, and digital forensics. With cybercrime becoming more sophisticated, the demand for cybersecurity experts in the banking sector is expected to continue growing.

3. Payment Data Analysts

The massive volume of digital transactions generates vast amounts of data. Payment data analysts are professionals who analyze this data to extract valuable insights that can drive business decisions. By examining patterns in consumer spending, payment behavior, and market trends, data analysts help banks optimize their payment services and improve customer experiences.

These professionals play a crucial role in understanding how digital payment systems perform, which products and services are most popular, and how to tailor offerings to specific customer needs. A background in data science, statistics, and finance is ideal for individuals looking to pursue this career path.

4. Blockchain and Cryptocurrency Specialists

Blockchain technology and cryptocurrencies are rapidly gaining traction in the world of digital payments. Blockchain offers a decentralized and secure way to process transactions, while cryptocurrencies like Bitcoin and Ethereum provide alternative payment methods that do not rely on traditional banking systems.

As financial institutions explore the potential of blockchain and cryptocurrencies, there is a growing demand for specialists who understand the technology and its applications in the banking sector. Blockchain and cryptocurrency specialists help banks implement blockchain-based payment systems, develop digital currencies, and explore new ways to conduct cross-border payments.

These professionals require a deep understanding of blockchain technology, cryptography, and the regulatory environment surrounding digital currencies. Blockchain and cryptocurrency roles are among the most exciting career paths emerging in the financial industry today.

5. Digital Marketing and Customer Experience Managers

As digital payments become more integrated into everyday life, banks are focusing on improving the customer experience to attract and retain users. Digital marketing and customer experience managers are responsible for promoting digital payment solutions and ensuring that customers have a seamless and user-friendly experience with online payment platforms.

These professionals are experts in digital marketing strategies, customer relationship management, and user experience (UX) design. They work to create targeted campaigns that increase adoption of digital payment methods and enhance customer satisfaction. A career in digital marketing within banking offers the opportunity to combine creativity with technological innovation.

6. Regulatory and Compliance Officers

With the rapid growth of digital payments, regulatory frameworks are evolving to ensure that financial transactions remain secure, transparent, and compliant with local and international laws. Regulatory and compliance officers in banking ensure that digital payment systems adhere to industry standards, legal requirements, and anti-money laundering (AML) regulations.

These professionals monitor digital payment activities, conduct audits, and work with regulators to ensure that banks are compliant with new and existing regulations. As the digital payment landscape continues to evolve, the need for regulatory experts who understand both finance and technology is becoming increasingly important.

Conclusion

Digital payments are revolutionizing the banking sector, creating new opportunities for professionals in various fields. From payment specialists and cybersecurity experts to blockchain developers and data analysts, there is no shortage of exciting career paths for those interested in the intersection of finance and technology. As the world continues to move toward a cashless society, the demand for skilled professionals in digital payments will only continue to grow.

For individuals looking to pursue a career in banking, this is the perfect time to explore the many roles that digital payments are creating. By gaining expertise in these areas, you can position yourself at the forefront of the banking industry’s digital transformation and play a key role in shaping the future of finance.