Bank of America overhauls rewards program

Bank of America Introduces Revolutionary Rewards Program Bank of America is set to unveil a groundbreaking rewards program on May 27, aimed at expanding benefits to a wider customer base. This move marks a significant milestone for the financial giant, as it will now offer rewards to any customer with a personal checking account, regardless […]

Banking Associate Part Time 30 Hour (Jamaica)

About the Banking Associate Role at TD Bank TD Bank is a leading global financial institution and the fifth-largest bank in North America. It has over 27 million customers worldwide and more than 95,000 employees. TD Bank is committed to providing its customers with a simplified banking experience, underpinned by human interactions. This is achieved […]

Banking Associate – Stowe, VT

TD Bank: Providing Exceptional Banking Services in Stowe, Vermont TD Bank, one of the world’s leading global financial institutions and the fifth largest bank in North America by branches/stores, is now hiring a Banking Associate in Stowe, Vermont, United States of America. This financial institution is committed to being a leader in client experience, reimagining […]

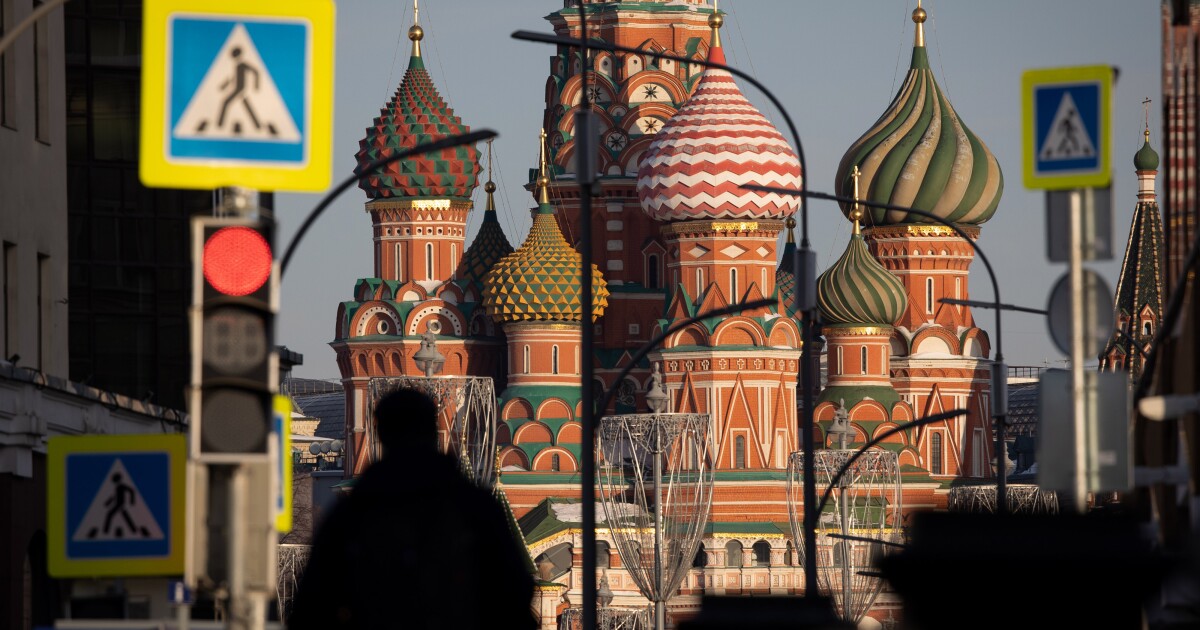

Citi completes sale of its last remaining Russian unit

Citi Group Completes Exit from Russia Following a process that took nearly four years, Citi Group has finally closed its exit from Russia by selling off its last remaining subsidiary in the country. This decision was made public on Wednesday and marks the end of Citi’s operations in the Russian market.Citi began this process back […]

Betterment’s next-gen challenge to ‘grandparent’ RIA custodians

Introduction Though perhaps still best known as a robo-advisor, Betterment is making strides in competing against industry giants like Charles Schwab and Fidelity Investments in supporting RIAs. The firm recently announced plans to test a new advisor referral program, showcasing its commitment to the RIA market. Processing Content On Feb. 10, Betterment filed with the […]

What is private credit? What are private credit jobs?

Much has been said about private credit. Since the pandemic it’s been the part of the financial services industry that everyone wants to work in, based on growth of around 50% since 2020 – from $2tn to $3tn – according to Morgan Stanley. Click here to join the bubble by eFinancialCareers, our new anonymous community. […]

Data breach hits 1 million Figure customers

Massive Data Breach Hits Figure Technology Solutions Figure Technology Solutions, a blockchain-based lender, has fallen prey to a significant data breach incident. Almost 1 million customer accounts have been compromised by a data breach extortion group. The attacker, known as ShinyHunters, has leaked personal information such as names, physical addresses, phone numbers, dates of birth, […]

Economists warn of emerging ‘sovereign-stablecoin nexus’

The Emerging Nexus Between Stablecoins and Sovereign Bonds In recent times, the world of finance has witnessed an intriguing development as stablecoins are becoming increasingly intertwined with government bond markets. This evolving relationship, referred to as the “sovereign-stablecoin nexus”, is expected to not only reshape the structure of financial markets but also pose potential liquidity […]

California community bank agrees to new union deal

Communications Workers of America Continue Efforts to Unionize Financial Services Industry The Communications Workers of America (CWA) is pushing forward in its multiyear endeavor to organize workers in the financial services sector. According to the CWA’s lead organizer, there has been a significant rise in union interest from employees across several major banks. This shift […]

Junior Bridgeman and his family’s generational wealth

The Bridgeman Family’s Journey to Generational Wealth The strategic meetings of the Bridgeman family began informally, revolving around meals, as Junior Bridgeman’s children showed interest in his businesses and investments. These gatherings evolved into quarterly sessions and later transitioned to monthly meetings focused on exploring potential investments and business opportunities. The family’s commitment to these […]