LA bank is latest lender to be ensnared in alleged fraud saga

Preferred Bank Caught in Alleged Borrower Fraud Saga Preferred Bank, a $7.6 billion-asset bank based in Los Angeles, has found itself entangled in a high-stakes alleged borrower fraud saga that has previously implicated two larger Western banks. This development comes as Preferred Bank downgraded $115 million worth of loans to nonaccrual status this week. These […]

Family offices can shield HNW clients from cybercrime

Cybercrime attacks on high net worth individuals have been on the rise, enabled by the increasing sophistication of cyberthieves. Processing Content Sarah Rosen is the managing director of private client services at BlackCloak. Ever-patient hackers can now lurk undetected in individuals’ systems and accounts for weeks or even months waiting to strike. When they do, […]

Citadel Securities is now inviting European quants to compete to enter its competition

European STEM Students Compete for Citadel Securities Quant Invitational If you’re a European STEM student with aspirations of becoming a quant at Citadel Securities, you may want to consider participating in their upcoming competition. Citadel Securities is known for its rigorous selection process, with only 0.4% of applicants being accepted for internships worldwide. To stand […]

Interview: Unlimit’s Yulia Shevchenko on the regulatory reality behind global fintech expansion

Unlimit: Mastering Global Fintech Expansion For the last 11 years, Yulia Shevchenko has held a key position at Unlimit, a global fintech powerhouse. She has led licensing and regulatory authorisations across diverse continents such as Europe, the UK, the US, Asia, and Africa. Her role has provided her with unique insights into how fintech products […]

Associate Bank Financial Advisor | Wayne, PA, USA

About the Role: Associate Bank Financial Advisor at Wells Fargo Wells Fargo, a renowned American multinational financial services company, is currently seeking an Associate Bank Financial Advisor. This role falls under the Wealth and Investment Management division of Wells Fargo Advisors. Interested candidates can learn more about the various career areas and business divisions at […]

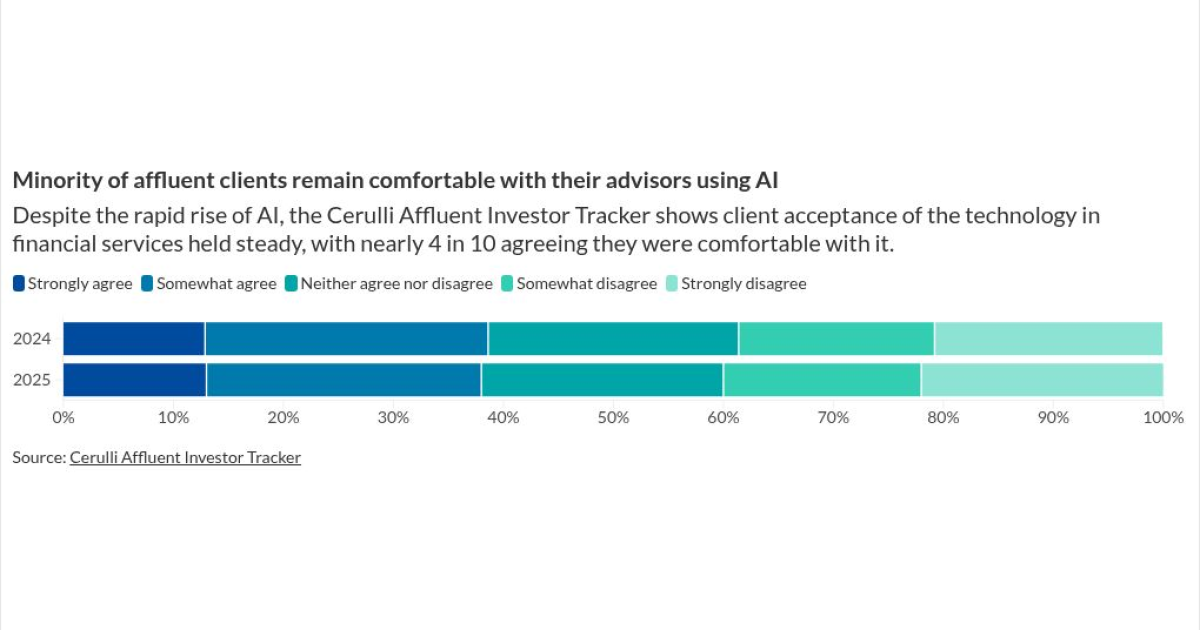

Older, wealthier clients are wary of AI. Here’s how to build trust

Older, Wealthier Clients Are Wary of AI: Building Trust Clients who are older and more affluent are significantly more skeptical about their advisors’ use of artificial intelligence than younger investors — a divide that underscores the need for transparency in communication about the technology. A new report by research firm Cerulli Associates found that 38% […]

Block replacing 40% of its staff with AI | PaymentsSource

Key Insights Block plans to lay off about 40% of its workforce, with CEO Jack Dorsey stating bluntly that improvements in artificial intelligence are quickly changing how companies will operate in the future. Expert Quote: “Something has changed. We’re already seeing that the intelligence tools we’re creating and using, paired with smaller and flatter teams, […]

Edward Jones gets green light to launch industrial bank

Edward Jones Receives Approval to Open Industrial Bank The financial advisory firm, Edward Jones, has gained state and federal consent to establish an industrial bank. This approval follows a long-standing application period started six years ago and signifies a significant milestone for the company, which first applied for an industrial loan charter in 2020. The […]

Collapse of UK property lender sends shockwaves through Wall Street

The Collapse of Market Financial Solutions Major Wall Street lenders are trying to comprehend the potential losses linked to their loans to a UK-based mortgage provider, Market Financial Solutions (MFS), which collapsed abruptly due to allegations of fraud. This incident has once again raised concerns over the underwriting standards in the rapidly growing market for […]

DOL moves to undo stricter independence test for brokers

The definition of an “independent contractor” — long a political ping-pong ball — could bounce back in brokerage firms’ direction under a new federal proposal put forward this week. Processing Content Broker-dealers and groups representing them expressed tentative praise for a Department of Labor proposal that would simplify the criteria firms must use when determining […]