Seasonal Banking Jobs: How Easter Brings Short-Term Career Opportunities in the Financial Sector

Easter is traditionally associated with family gatherings, festive meals, and religious observance. However, for the financial sector, this holiday represents more than just a time of celebration—it’s also an opportunity for seasonal banking jobs to flourish. As Easter approaches, banks and financial institutions experience a surge in demand for their services, particularly in areas like […]

How Easter Shopping Trends Are Shaping Mobile Banking and Payment Solutions in 2025

Easter, traditionally a time for family gatherings, egg hunts, and religious observance, has evolved into one of the most significant shopping periods in the United States. In 2025, as digital technology continues to shape consumer habits, Easter shopping trends are influencing how people interact with mobile banking and payment solutions. With mobile devices playing a […]

How Augmented Reality (AR) is Revolutionizing the Customer Experience in Banking

In the ever-evolving world of banking, technology plays a crucial role in shaping the customer experience. One of the most exciting innovations transforming the way banks interact with their customers is Augmented Reality (AR). Traditionally, banking has been seen as a practical, sometimes even mundane, service. However, with AR’s rise, banks are now able to […]

The Shift from Branch Banking to Virtual Banking: New Career Opportunities

In recent years, banking has undergone a significant transformation, driven by advancements in technology and changing customer preferences. Traditional branch banking, which once relied heavily on face-to-face interactions, is gradually being replaced by virtual banking. With the rise of online and mobile banking, customers can now perform transactions and access services from the comfort of […]

Understanding the Role of RegTech in Transforming Compliance Jobs

In recent years, regulatory technology, commonly known as RegTech, has emerged as a game-changer in the financial services industry. As financial institutions face an increasingly complex regulatory landscape, RegTech is helping them manage compliance more efficiently, cost-effectively, and accurately. For professionals working in compliance roles, RegTech has not only transformed the way compliance tasks are […]

How to Stay Relevant in the Evolving Banking Industry: Continuous Learning

The banking industry is experiencing rapid transformations, driven by advancements in technology, changing customer expectations, and evolving regulatory frameworks. In this dynamic environment, staying relevant as a banking professional requires more than just meeting the current job requirements. It demands a commitment to continuous learning. As new tools, technologies, and strategies emerge, adapting to these […]

The Future of Mortgage Lending Careers in a Digital-First World

The mortgage lending industry is undergoing a massive transformation. As we move into a digital-first world, the way mortgages are originated, processed, and managed is changing rapidly. Technologies like artificial intelligence, machine learning, and cloud computing are reshaping every facet of the mortgage process, from underwriting to closing. As these technological advancements continue to gain […]

Impact of Cloud Computing on Banking Job Roles and Operations

In the past decade, the financial sector has seen an incredible transformation, driven by technological advancements, with cloud computing at the forefront. Cloud computing has not only revolutionized how banks store and manage data but has also significantly impacted job roles and the overall operational landscape of the banking industry. As more financial institutions adopt […]

How Artificial Intelligence Is Automating Customer Service Jobs in Banks

In recent years, artificial intelligence (AI) has become a transformative force in many industries, and the banking sector is no exception. One of the most significant changes brought about by AI is in customer service roles. With advancements in AI technologies such as chatbots, virtual assistants, and machine learning algorithms, banks are increasingly automating customer […]

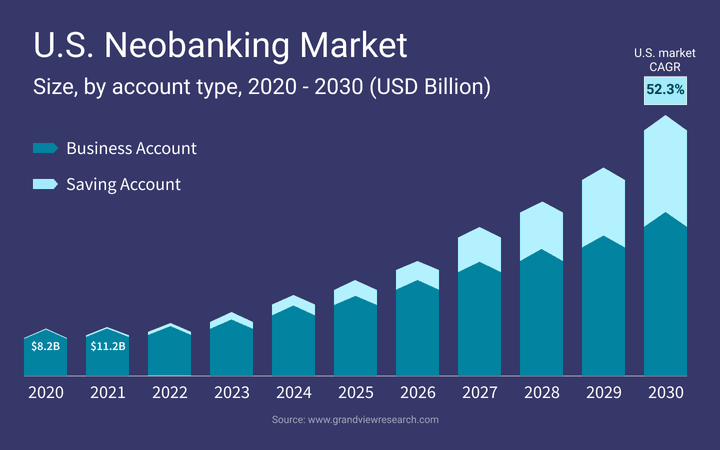

The Growth of Neobanks and What It Means for Employment in Traditional Banks

The banking landscape has been undergoing significant transformations in recent years, and at the heart of this shift is the rise of neobanks. These digital-first, branchless financial institutions have gained tremendous momentum, attracting millions of customers and transforming how we think about banking. But what does this growth mean for traditional banks and, more importantly, […]