Emerging as a key player in the bustling financial landscape, First Citizens BancShares has taken a significant leap with its strategic expansion in Boston. The bank’s decision to acquire the failed Silicon Valley Bank during the 2023 banking crisis marked its first venture into the Boston area. This move not only underscores the bank’s ambition but also mirrors the trend of superregional and national banks expanding their footprint in Boston.

Unfolding the Boston Banking Landscape

Over the past five years, Boston has witnessed a surge of banks seeking to establish a robust presence. Leading the pack is JPMorganChase with 50 new branches. Other notable players like PNC Financial Services Group and M&T Bank are also vying to disrupt Bank of America’s dominant market share. 2023 saw Cleveland-based KeyCorp declaring its intention to expand in the Boston area, a move that complements its existing commercial banking operations.

What’s the pull factor? The answer lies in Boston’s affluent status compared to other U.S. metropolitan areas of similar size. The city’s thriving sectors include healthcare, biomedical research, tech, and venture capital. Furthermore, it is home to roughly 50 colleges, including prestigious institutions like MIT and Harvard, that consistently spin off new firms.

“All these businesses are very attractive to banks,” says Ally Akins, a principal at Washington D.C.-based bank consulting firm Capital Performance Group.

The Local Landscape

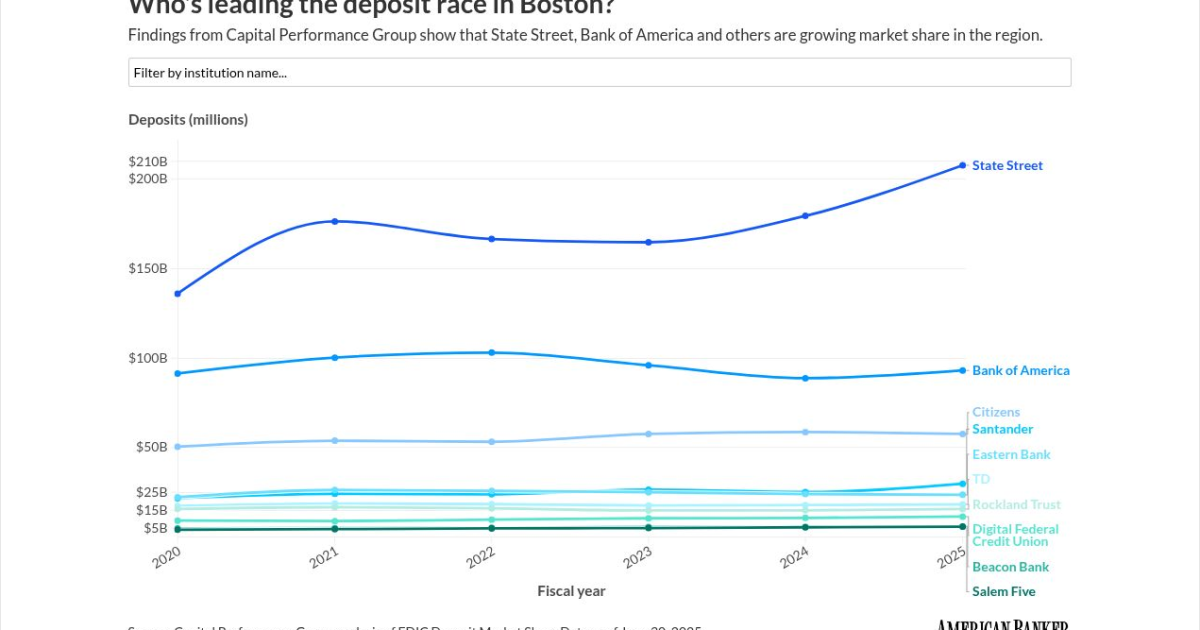

Akins further elaborates that the local banking landscape is currently dominated by Bank of America, Citizens Financial Group, and Santander US, holding a combined 47% of local deposits. However, the landscape is also witnessing a flurry of local bank mergers, pointing to a reshaping of the banking ecosystem. This dynamic environment is creating ample opportunities for community banks, allowing them to compete with larger banks on the strength of their customer service and personalized approach.

First Citizens’ Strategic Approach

First Citizens, recognized by American Banker as the top-performing bank with more than $50 billion in assets for two consecutive years, has made a confident entry into this evolving landscape. “We’re pretty happy with Boston,” says Ron Sanchez, who oversees the Boston area and seven adjacent states for First Citizens. “It presents some strong opportunities we don’t have in other markets.”

Under Sanchez’s leadership, First Citizens is leveraging the technology it acquired with its SVB purchase to fuel faster growth. The bank’s strategy involves retaining existing clients and using outbound selling to attract new customers. Sanchez believes in the value of personal interaction in banking, stating, “People want to bank with people.”

Building on SVB’s Legacy

As First Citizens works to integrate SVB, it is also focusing on building its wealth management arm. The bank has already hired 50 advisors in 2025. It aims to leverage SVB’s 40-year legacy in Boston, especially in lending to venture capital and private equity firms and the startups they fund. This strategy is seen as part of the bank’s “seed to bloom to legacy” approach to building long-term relationships with young companies and their founders.

First Citizens’ vice chairwoman, Hope Holding Bryant, who runs the bank’s branches and wealth management arm, was quoted during a recent visit to Boston, saying, “Dwight, can you imagine what this city’s going to mean to this organization in five years?”

The takeaway from First Citizens’ strategic moves in Boston is clear: the city is poised to become a key battleground for banks looking to expand their presence and diversify their client base. First Citizens’ bold steps in this direction serve as a testament to the bank’s ambition and its commitment to its clients.

For more details, visit the source link Here.