Grab Acquires Stash, Marking Its Entry into the U.S. Market

In a significant move towards global expansion, the Singaporean ride-sharing and financial services platform, Grab Holdings, has announced its acquisition of the American investing fintech, Stash Financial. This strategic purchase marks Grab’s entrance into the U.S. market, further broadening its global footprint in the financial services sector. The details of the acquisition were revealed in Grab’s annual earnings report, signaling a promising financial position for the company.

About the Acquisition

The deal involves an initial investment of $425 million, with the total payment being a combination of cash and stock. Grab has committed to acquiring a 100% equity interest in Stash over the next three years. The initial payment will cover 50.1% of the transaction, with the remaining amount to be paid out over the subsequent three years at the fair market value. The acquisition is expected to close in the third quarter of 2026, subject to regulatory approvals.

Stash, a subscription-based investment advisory app, currently manages approximately $5 billion in assets for around 1 million customers. The fintech company provides banking services through Stride Bank, which also serves other notable fintechs such as Affirm and Chime. Stash’s innovative services include offering stock rewards on its card products, a feature that has made it a popular choice among users.

Grab’s Growth and Financial Performance

Founded in 2015, Grab has rapidly expanded its services to include ride-sharing and mobile payments, serving around 50 million monthly customers across eight Southeast Asian countries. The company also operates digital banking services in Singapore, Malaysia, and Indonesia. In 2025, Grab achieved its first full-year net profit, with revenue reaching $3.37 billion.

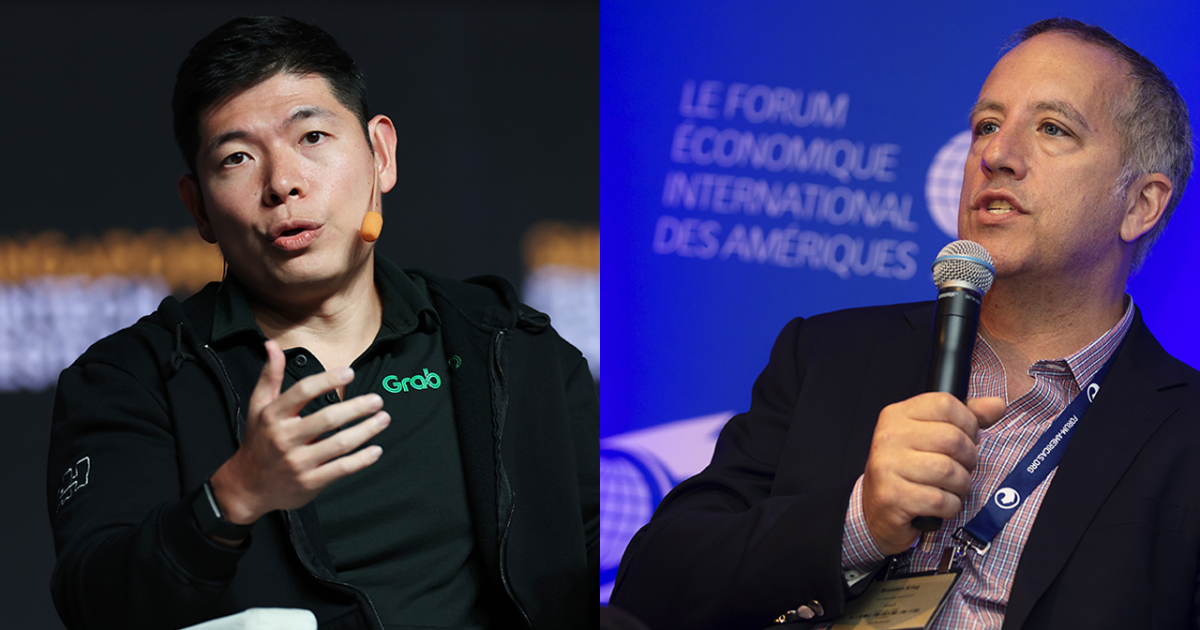

In a statement regarding the acquisition, Grab CEO Anthony Tan expressed that this move reinforces the company’s mission of democratizing financial services for everyone. Mizuho Securities also maintained an Outperform rating for the company, citing that Grab had exceeded its consensus estimates by 5%.

Future Plans

Once the acquisition is complete, Grab intends to support Stash’s growth in the U.S. consumer market and introduce Stash’s investing solutions in Southeast Asia. Stash will continue to operate as a standalone entity within Grab’s business, with its executive leadership remaining intact. This acquisition is expected to generate around $60 million in earnings for Grab in 2028.

Stash co-CEO Brandon Krieg expressed enthusiasm about the acquisition, stating that it will provide the resources to accelerate their vision of AI-driven financial guidance for millions of people.

In conclusion, Grab’s acquisition of Stash not only marks its entry into the U.S. market but also reinforces its commitment to expanding its financial services portfolio. With its solid financial performance and strategic growth plans, Grab continues to make strides in the global financial services sector.

For more details, refer to the original source Here.