Varo Bank Secures $123.9 Million Amidst Balance Sheet Contraction

Varo Bank, a San Francisco-based neobank, announced on Monday that it had secured $123.9 million in new capital, providing a much-needed boost as the bank continues to grapple with net losses despite a record high in operating income. This announcement comes days after the bank released financial data for the fourth quarter of 2025. The source reported that Warburg Pincus led the investment round, joined by new investor Coliseum Capital Management. This demonstrates continued support from private backers despite the bank’s fluctuating financial health.

Varo Balances Regulatory Costs with Profitability

Varo Bank, which made history in 2020 by becoming the first consumer fintech to obtain a national bank charter, has been wrestling with the high regulatory costs of its charter. The capital injection will help the bank balance these costs while also striving to grow its lending business and achieve profitability. This is a crucial pivot point for the bank, as its fourth-quarter results revealed a net loss of $20.8 million, a 16.2% increase from the previous year, despite hitting a record operating income.

Board Expansion to Drive Governance and Risk Discipline

In addition to the funding announcement, Varo revealed significant additions to its board of directors. Alice Milligan, former Chief Marketing Officer at Morgan Stanley, and Kevin Watters, former Division CEO at JPMorgan, have joined the board. The two bring a wealth of experience and knowledge to the bank, which is expected to help guide governance and risk discipline. In a joint statement, Milligan and Watters emphasized Varo’s unique market position, outlining the bank’s success in pairing a technology-first customer experience with a rigorously disciplined approach to governance and risk.

Varo’s Financial Health: A Mixed Picture

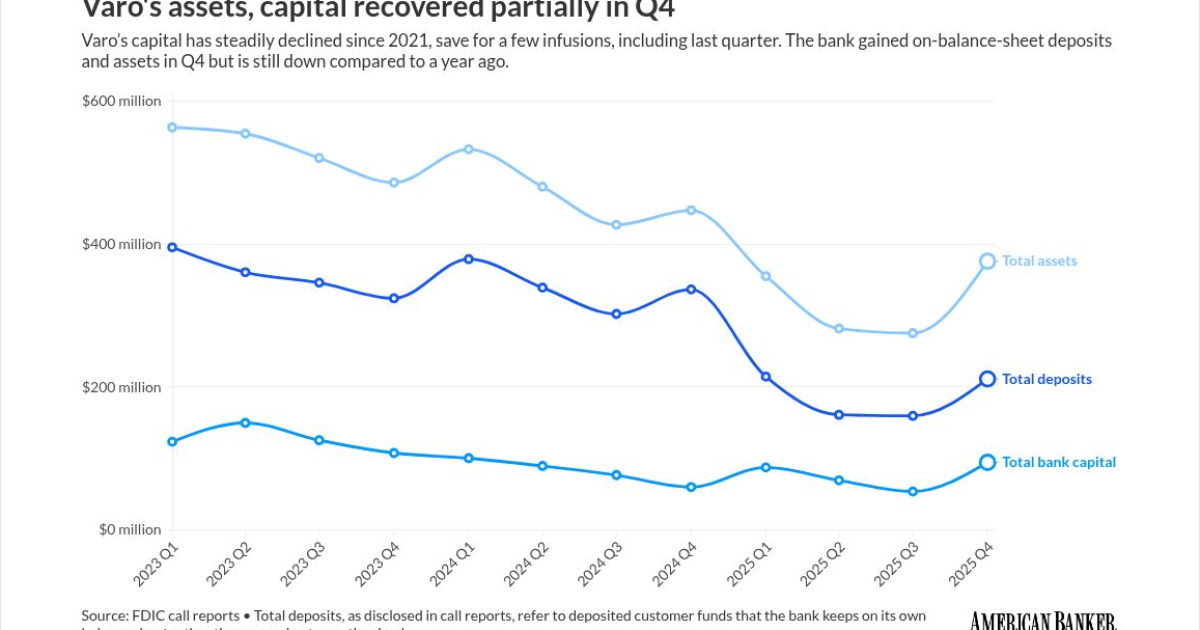

Varo’s latest call report, which provides a snapshot of the bank’s financial performance for the fourth quarter of 2025, offers a mixed view of its efforts to achieve profitability. On one hand, the bank reported an adjusted operating income of $38.6 million for the quarter, a 7.7% increase from the same period a year ago, marking a new high for the institution.

On the other hand, Varo continues to operate in the red, with a net loss of $20.8 million in the fourth quarter, up 16.2% from a loss of $17.9 million a year ago. Furthermore, the bank’s balance sheet reflected a contraction in certain areas. For instance, total deposits — the amount of deposited customer money that the bank keeps on its own balance sheet rather than sweeping to another bank — fell to $211.4 million, a 37.2% decline from the previous year.

Looking Ahead

Despite these challenges, Varo remains optimistic about its future. With the recent capital injection and the addition of seasoned banking experts to its board, the bank is well-positioned to navigate the complexities of the fintech market. Chris Shackelton, co-founder and managing partner of Coliseum Capital Management, expressed similar optimism about Varo’s trajectory, stating, “We believe Varo is building a resilient and scalable platform from which to capitalize on a significant market share opportunity.”

As Varo continues its pursuit of profitability, it remains to be seen how the neobank will leverage its new capital and leadership to address its financial health and continue delivering innovative banking solutions to its customers.